Market Verdict on Iron Ore:

· Iron ore short-run neutral.

Macro

· China National Bureau of Statistics spokeman said to pay attention to the fast increase on industrial raw materials, and decrease the cost pressure on enterprises by enhancing the market regulation.

· China May above designated scale industrial enterprises added value at 8.8% y-o-y, the growth rate down 1% m-o-m. Jan- May growth rate 17.8%, up 7% compared to the average of the year 2020 and the year 2019.

· According to the U.S. Fed’s matrix, seven officials expect to raise interest rates by the end of 2022 (four in March). For the first time, interest rates will be raised twice before the end of 2023. S&P500 created the biggest single day correction over the past four weeks, and the dollar index rose above 91 for the first time in this month.

Iron Ore Key Indicators:

· Platts 62%: $213.65 (-8.70) MTD $213.34. Platts corrected massively following the correction of SGX and DCE, as well as the decreasing buying interest on seaborne ores. The seasonal demand come to a turning point.

SGX Iron Ore 62% Futures& Options Open Interest (Jun 16th)

· Futures 83,330,900 tonnes(Increase 974,400 tonnes)

· Options 81,964,800 tonnes(Increase 705,000 tonnes)

Steel Key Indicators

· Tangshan 10 sample steel mills pig iron before tax 3585 yuan/tonne, billet cost 4505 yuan/tonne, up 52 yuan/tonne w-o-w. Gross profit 435 yuan/tonne.

· China crude steel daily production in May at 3.21 million tonnes, refreshed the May record historically.

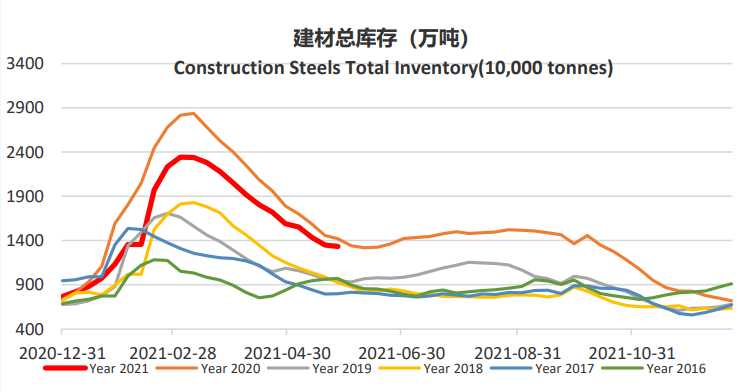

· MySteel Rebar Inventory: Rebar production 3.8 million tonnes, up 2.35% w-o-w. Mills inventory 3.3 million tonnes, up 5.25% w-o-w. Circulation inventory 7.54 million tonnes, up 2.72% w-o-w.