A total of 1.106 million mt of iron ores was traded for the week ended Jun 18, amid extended output curb in Tangshan and improving steel margins.

According to Platts, the Chinese domestic hot-rolled coil and rebar sales profit margins averaged to decent range of $155/mt and $149/mt over June 1-15, respectively, though lower than the record high level by mid-May at $278/mt to $275/mt.

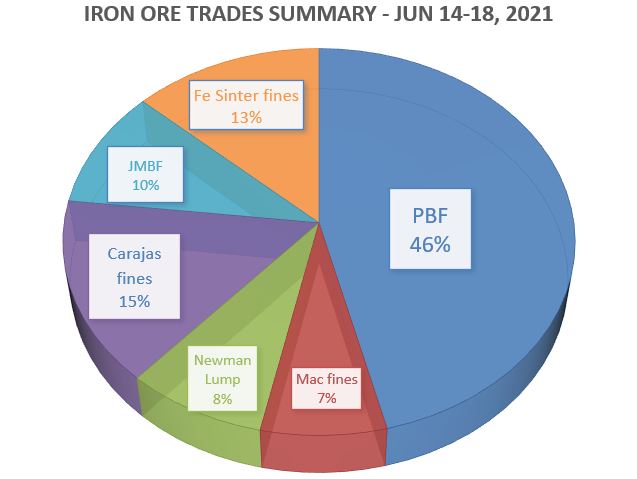

During the week, the trades volume of PBF accounted the largest market share at 46%, then followed by Carajas fines at 15%, and lastly Fe Sinter fines at 13%.

Chinese mills still prefer mainstream fines

Most of the Chinese mills still preferred mostly mainstream medium grade fines, which were under tight supply, and they were seeking for higher grade fines like the Carajas fines as well.

There was also some demand for low grade fines, as some mills with flexible furnace mix had adopted low-high combination in blending for cost savings estimated at around RMB 100/wmt.

However, the popularity of Yandi fines had fallen among Chinese trade participants due to market concerns over its supply and cost efficiency of the grade, which was less stable as compared to other Australian low-grade fines and Indian low grade fines.

Lump demand remains firm on supply tightness

The lump premium remained firm, due to supply tightness especially among river port stockpiles in China.

However, there was growing preference for non-mainstream lump as well as on pellet which was deemed for its cost efficiency.

Meanwhile, there was also rising market enquiries from Japanese steel mills that lifted the lump premiums.