A total of 0.87 million mt of iron ores was traded for the week ended Jun 25, amid the typical lull steel demand period.

However, there was some upticks in steel prices late in the week, as it was heard that some mills had voluntarily reduced their sintering and blast furnace operations ahead of the 100th anniversary of Chinese Communist Party on July 1.

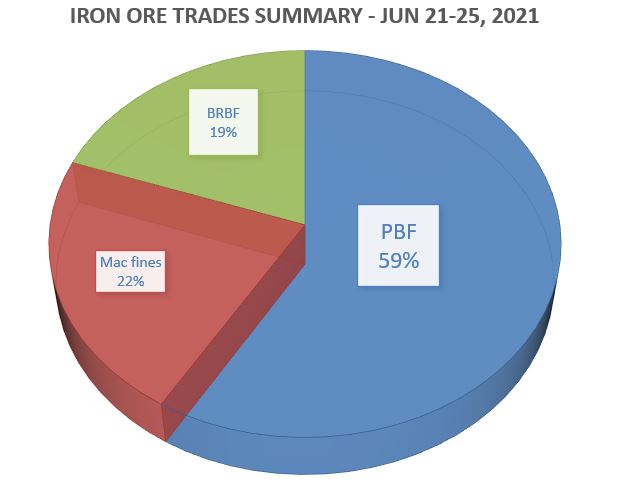

During the week, the trades volume of PBF accounted the largest market share at 59%, then followed by MAC fines at 22%, and lastly BRBF at 19%.

No change in blending for Chinese mills

The massive share of traded PBF, implied that most Chinese mills kept their blending unchanged, focusing at medium and high-grade iron ore like PBF and Carajas fines.

However, there was still supply tightness among Chinese ports for iron ore products like PBF, BRBF and Carajas fines, which resulted in some price upticks during the week.

Meanwhile, there was some market talks of relaxation output curb in Tangshan by July, though it was yet to be confirmed by Chinese authority, which some trade participants believed that it would lead to more steel demand in July.

More imports for semi-finished in July

Some market participants expected higher import of semis will reduce steel production and the need for iron ore in coming months.

As the country’s import of semi-finished steel imports saw a sharp jump by 41% on-month to 1.23 million mt in May, with strong indication of higher import volume in June and July.

The higher semi-steel imports were also in line with Chinese authority’s policy of cutting steel output to reduce emission to comply with green initiatives.