A total of 1.35 million mt of iron ores was traded for the week ended Jul 2, amid reduced steel production for centenary political party celebration in Jul 1.

Thus, many trade participants saw the production cut as temporary and will soon resume after the celebration to support higher steel output in early July.

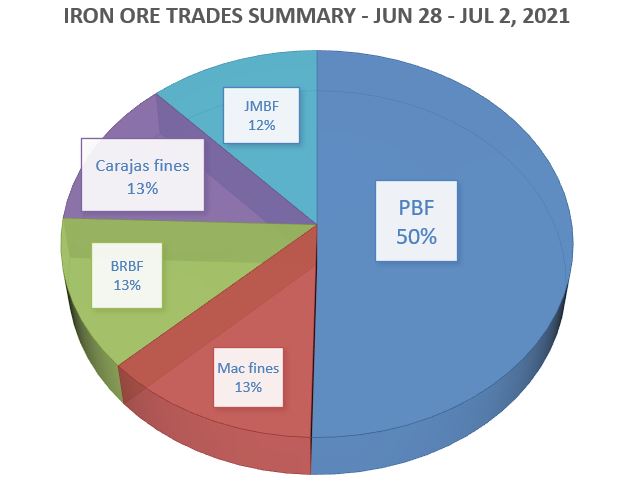

During the week, the trades volume of PBF accounted the largest market share at 50%, then followed by Carajas fines at 13%, and BRBF at 13% too.

Persisted supply tightness for PBF

Due to the short-term production cut, many Chinese mills continued to rely on mainstream medium fines like PBF for blending.

Though, some mills were heard to be reducing PBF usage in blending and used other alternative medium grade fines like MAC fines, Jimblebar fines for cost-savings.

Meanwhile, there was also tight supply for BRBF among port stocks, though some trade participants expected Brazilian supply to improve with more shipments in Q3.

Lower lump demand in July

Some market participants expected lower demand for lump after the Centennial celebration due to stricter sintering restrictions.

In the meantime, the lump supply continued to tighten among rivers ports and supported the recent jump in premiums.

Thus, some Chinese mills were heard to cut high grade lump usage, preferring to use lower grade lump, pellet or rise sintering rate as alternatives to save costs in the blast furnace mix.