Market Verdict on Iron Ore:

· Iron ore short-run neutral.

Macro

· A senior official of the IMF said the global output gap of about $15 trillion caused by the Covid-19 crisis, needed “tough reforms” in product, labor and financial markets.

· US Deputy Secretary of state Sherman will visit China from July 25 to 26th. China will expound to the U.S. its position on developing bilateral relations.

· The US expected to run out of debt ceiling measures in October or November, according to the CBO.

Iron Ore Key Indicators:

· Platts 62% 213.60 (-6.45), MTD 219.16.

· Anglo America published Q2 production and sales report. Kumba iron ore production 9.82 million tonnes, down 7% from Q1. Sishen production 6.88 million tonnes, down 3%. Kolomela production 2.94 million tonnes down 16%. Minas Rio production 5.88 million tonnes, up 5%. The year 2021 expected total production at 64.5 – 66.5 million tonnes, lower than previous expected 64.5- 67.5 million tonnes range.

SGX Iron Ore 62% Futures& Options Open Interest (Jul 21st)

· Futures 85,996,700 tonnes(Increase 1,227,800 tonnes)

· Options 82,855,400 tonnes(Increase 62,500 tonnes)

Steel Key Indicators

· Tangshan 10 sample steel mills pig iron before tax 3760 yuan/tonne, billet cost 4722 yuan/tonne, up 33 yuan/tonne w-o-w. Gross profit 458 yuan/tonne, up 27 yuan/tonne.

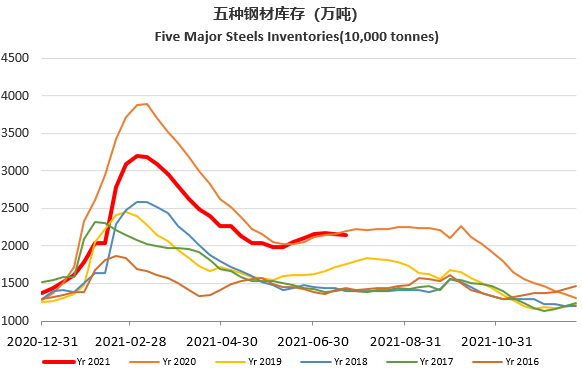

· MySteel Rebar Inventory: Rebar production 3.35 million tonnes, down 5.5% w-o-w. Mills inventory 3.12 million tonnes, down 3.94% w-o-w. Circulation inventory 8.24 million tonnes, down 0.39% w-o-w.

· China Henan Meteorological Station continued to issue Red Rainstorm warning at 04:30 on July 22nd. Hebei meteorological station issued red warning signal of Rainstorm at 20:29 on July 21st. Strong typhoon will land on East China on July 26th.