Market Verdict on Iron Ore:

· Iron ore short-run neutral.

Macro

· U.S. Federal maintained 0-0.25% unchanged as interest rate, fell in expectation.

· FTSE A50 Index rebounded near 3% overnight. Shanghai Equity rebounded 1.5% in early afternoon.

Iron Ore Key Indicators:

· Platts62 $201.25, +0.80, MTD $214.54.

· China Iron and Steel Association(CISA): The “China 14th Five Year Plan” took the opening of domestic iron ore as a national strategy, eliminated policy obstacles unfavorable to the development of iron ore resources, accelerated the development of domestic iron ore resources and improved the self-sufficiency percentage of domestic iron ore resources. Steadily promote the development and utilization of overseas resources, accelerate the construction of overseas large iron ore projects in West Africa and Western Australia, and increase the proportion of overseas iron ore asset. Promote a reasonable iron ore pricing mechanism. Standardize the VAT invoice in scrap industry and solve the difficulty of income tax verification, and increase the amount of domestic scrap resources.

SGX Iron Ore 62% Futures& Options Open Interest (Jul 28th)

· Futures 88,187,300 tonnes(Increase 709,400 tonnes)

· Options 85,599,400 tonnes(Increase 655,000 tonnes)

Steel Key Indicators

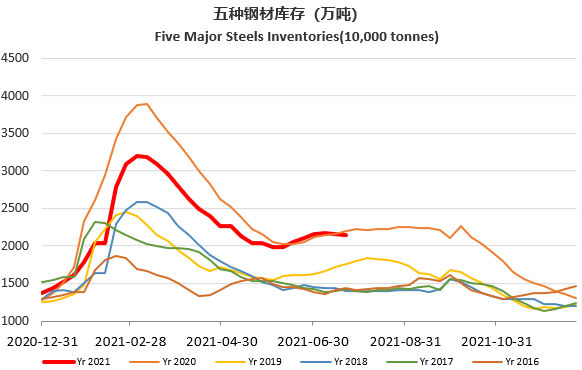

· MySteel Rebar Inventory: Rebar production 3.29 million tonnes, down 1.88% w-o-w. Mills inventory 3.097 million tonnes, down 0.67% w-o-w. Circulation inventory 8.24 million tonnes, up 0.01% w-o-w.

· CISA Principal Analyst: H2 China crude steel restriction was a key factor in the steel market. The Carbon neutralizing will absorb 20 trillion yuan investment in the next 20 years, which approximately equal to increase 500 yuan/tonne on steel production.

· Tangshan 10 sample steel mills pig iron before tax 3681 yuan/tonne, billet cost 4644 yuan/tonne, down 78 yuan/tonne w-o-w. Gross profit 596 yuan/tonne, up 138 yuan/tonne.