Market Verdict on Iron Ore:

· Iron ore short-run oversold, potential to maintain rebound and test high.

Macro

· China political conference required to maintain commodity price stable. China central bank propose to maintain a stable monetary in the second half year of 2021.

· Jiangsu closed 55 highway exits and entrances because of the new Delta variant Covid-19 cases spread.

· China NBS: July China PMI higher than mid-point 50 at 50.4%, 0.5% lower than previous month. China Caixin PMI 50.3, last 51.3. In general, China economy maintained expansive area, however slower.

Iron Ore Key Indicators:

· Platts62 $180.50, -14.50, MTD $211.99.

· Last week MySteel 247 sample steel mills blast furnace utilisation rate 74.35%, down 1.3% w-o-w, down 16.8%w-o-w. Daily pig iron production 2.31 million tonnes, down 32,200 tonnes w-o-w, down 204,200 tonnes y-o-y.

SGX Iron Ore 62% Futures& Options Open Interest (Jul 28th)

· Futures 88,187,300 tonnes(Increase 709,400 tonnes)

· Options 85,599,400 tonnes(Increase 655,000 tonnes)

Steel Key Indicators

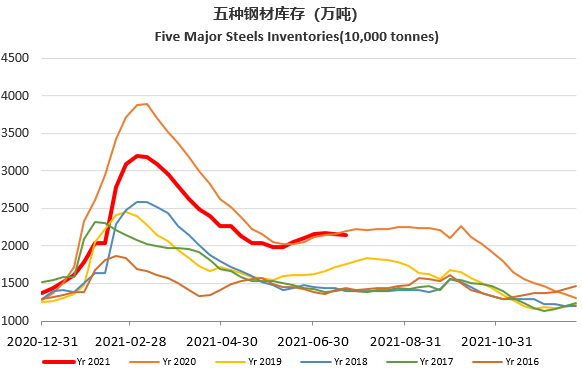

· Steelbank construction steels inventory 7.75 million tonnes, down 0.12% w-o-w. HRC inventories 2.78 million tonnes, down 1.21% w-o-w.

· Last week China 71 EAFs average utilisation rate at 67.3%, up 0.33% w-o-w. EAFs average profit at 437 yuan/tonne, up 121 yuan/tonne. EAFs steel margin realised a consecutive increase for the current four weeks.