A total of 750,000 mt of iron ores was traded for the week ended Aug 6, up 27.12% week-on-week, amid stringent steel output cuts being implemented.

Tangshan underwent a new round of sintering cuts much to the expectation of market participants, while iron ore prices ended its anti-gravity defying act and stayed under the $185/mt levels due to low steel demand.

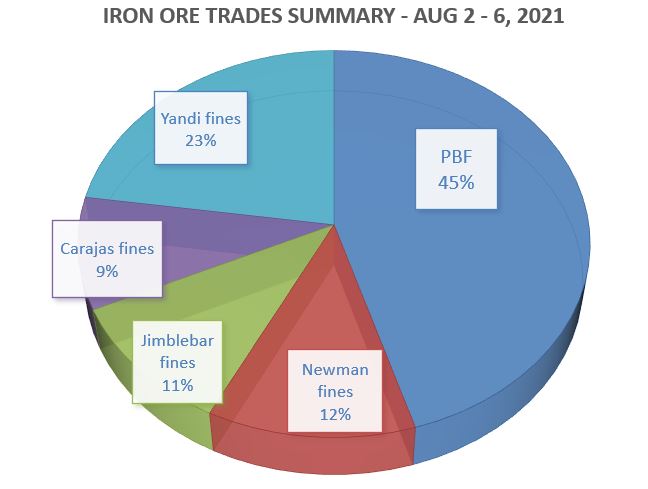

During the week, the trades volume of PBF accounted the largest market share at 45%, then followed by Yandi fines at 23%, and Newman fines at 12%.

Reselling cargoes amid low steel demand

Some Chinese mills were heard to be selling off their inventory even at a loss in their effort to destock and getting rid of excess inventory.

In the meantime, Chinese trade participants held back from purchases after a new round of sintering controls implemented in Tangshan. There was also trucking restriction to reduce air pollution for the steelmaking hub.

As most mills adopted cost saving mode, which sparked more interests for Australian low-grade fines like Fortescue Blend Fines and Super Special Fines.

More bearish market ahead amid output cuts

Trade participants expected lower steel demand in second half of the year, as typical of the summer season, when extreme weather affected construction activity.

However, there was more bearish market sentiments after the removal of scrap import tax since April and then followed by removal of steel export rebates in July, as Chinese authority stepped up to control steel output.

Furthermore, the steel productions were affected by power saving measures for Chinese provinces experiencing hot weathers, which reduced steel outputs for mills based in Guangxi, Guangdong and Sichuan with an estimated production loss of 27,000 mt per day since late July.