Market Verdict on Iron Ore:

· Iron ore short-run neutral.

Macro

· The U.S. Senate passed the 3.5 trillion U.S. dollar budget of Biden economic plan, used related to infrastructure investment.

· China Ministry of Finance: building fiscal and tax policies to promote green and low-carbon development, will support the iron and steel and coal industries to resolve excess capacity, constantly eliminate unqualified production capacity with high energy consumption and release advanced production capacity. Experts suggest that the existing environmental protection tax, refined oil consumption tax and coal resource tax should be integrated to the form of the new carbon emission tax.

Iron Ore Key Indicators:

· Platts 62%: $166.20 (+4.00) MTD $174.34.

SGX Iron Ore 62% Futures& Options Open Interest (Aug 11th)

· Futures 76,469,300 tonnes(Increase 162,200 tonnes)

· Options 69,487,400 tonnes(Decrease 60,700 tonnes)

Steel Key Indicators

· Tangshan 10 sample steel mills pig iron before tax 3587 yuan/tonne, billet cost 3199 yuan/tonne, down 17 yuan/tonne w-o-w. Gross profit 552 yuan/tonne, up 27 yuan/tonne.

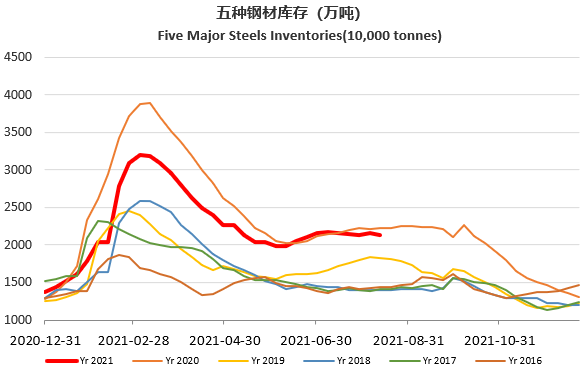

· MySteel Rebar Inventory: Rebar production 3.21 million tonnes, up 0.97% w-o-w. Mills inventory 3.4 million tonnes, up 1.07% w-o-w. Circulation inventory 8.06 million tonnes, down 1.15% w-o-w.

Coal Indicators

· China expected domestic produced coking coal up 22.3 million tonnes in the year 2021, import coking coals down 20.8 million tonnes. Total supply up 1.5 million tonnes. However the prime coal shortage estimated at 8 million tonnes.

· China National Development of Reform and Commission approved 7 Inner Mongolia Province coal miners, expected to increase 3.5 million coals on monthly basis.