A total of 760,000 mt of iron ores was traded for the week ended Aug 13, up 1.33% week-on-week, despite a short trading week with public holidays in Asia.

Steel demand remained bearish, due to the ongoing output cuts in China, though some trade participants were heard to purchase more cargoes to capitalize on the recent price corrections.

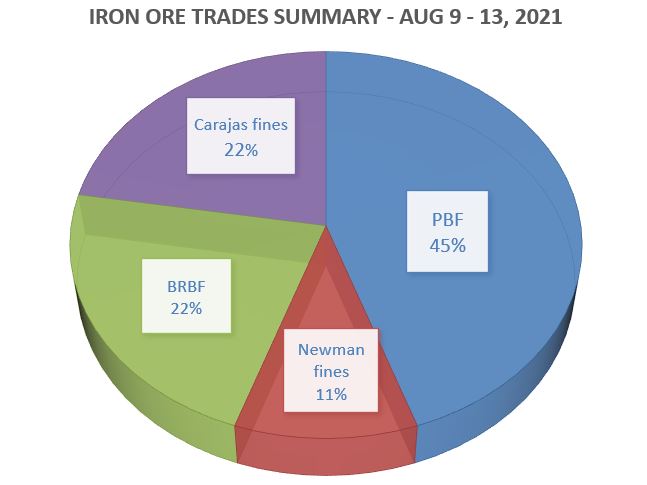

During the week, the trades volume of PBF accounted the largest market share at 45%, then followed by BRBF at 22%, and Carajas fines at 22% too.

More price corrections for imported iron ore

Trade participants expected some easing to the supply tightness situation with more cargoes arrival in August, which may result in more price corrections.

In the meantime, Chinese steel mills continued to prefer discounted cargoes against the 62% indexes as part of cost saving measures, amid the low steel margins environment.

Thus, some mills were heard to avoid the purchases of expensive high-grade fines in favor of medium grade fines and discounted low-grade fines like Super Special fines.

Lower premium for lump and pellet from reduced usages

Lump premiums are expected to drop further on low demand, as mills reduced lump usage in their blast furnaces to save costs.

Similarly, iron ore pellet premiums also fell from softening demand as market demand for high grade ores dropped on low steel margins environment.

As most mills tried to save costs in limiting their pig iron production and avoiding purchases of high-grade fines, lump, pellets and concentrates.