Market Verdict on Iron Ore:

· Iron ore short-run neutral.

Macro

· Indian PM Modi indicated India will start 100 trillion rupee(1.35 trillion U.S. dollar) in the new infrastructure projects to increase job roles and new energy projects.

· China central bank stated on Saturday that current Chinese Yuan potentially appreciate or depreciate, which potentially become volatile in a random area instead of a clear trend.

Iron Ore Key Indicators:

· Platts62 $160.85, -0.60, MTD $171.41.

· China July crude steel production 86.79 million tonnes, down 8.4% y-o-y. Pig iron production 72.85 million tonnes, down 8.9% y-o-y. Steel products 111 million tonnes, down 6.6% y-o-y.

SGX Iron Ore 62% Futures& Options Open Interest (Aug 13th)

· Futures 77,062,200 tonnes(Increase 472,500 tonnes)

· Options 70,984,900 tonnes(Increase 1,175,000 tonnes)

Steel Key Indicators

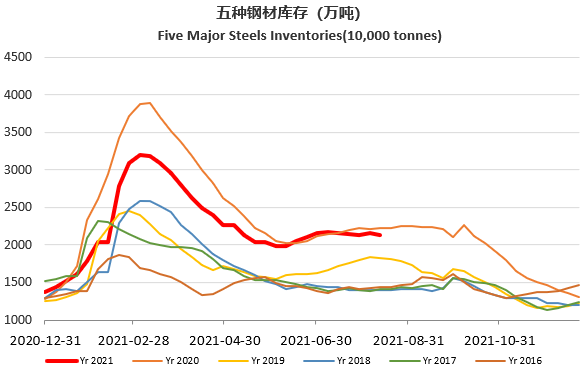

· Steelbank construction steels inventory 7.6 million tonnes, down 0.39% w-o-w. HRC inventories 2.77 million tonnes, down 0.53% w-o-w.

· Previous week 71 EAFs construction steel cost 4873 yuan/tonne, down 6 yuuan/tonne.

Coal Indicators

· China port 5500 Kcal thermal coal traded above 1000 yuan/tonne, close to historical high area again. Coal companies were operating at full load, however failed to finish orders from downstream. The port increase on coal price also due to the increasing freight cost and road transportation cost.