Market Verdict on Iron Ore:

· Iron ore short-run neutral.

Macro

· U.S. Federal officials reached agreement that potentially exit part of monetary ease policy in three months if economy presenting positive signs in future.

· U.S. Treasury Secretary Yellen said the Biden’s infrastructure and social projects expending bill was the “most important economy projects” in contemporary history. At the same time, Yellen refuted the idea claiming the “excessive investment” of the bill.

Iron Ore Key Indicators:

· Platts62 $159.50 (-3.00), MTD $169.51.

· August 9-15th: Big four iron ore miners total delivered 19.18 million tonnes, down 1.75 million tonnes w-o-w. Delivery to China 14.8 million tonnes, down 1.87 million tonnes w-o-w.

SGX Iron Ore 62% Futures& Options Open Interest (Aug 17th)

· Futures 80,191,000 tonnes(Increase 1,145,100 tonnes)

· Options 71,836,800 tonnes(Increase 351,900 tonnes)

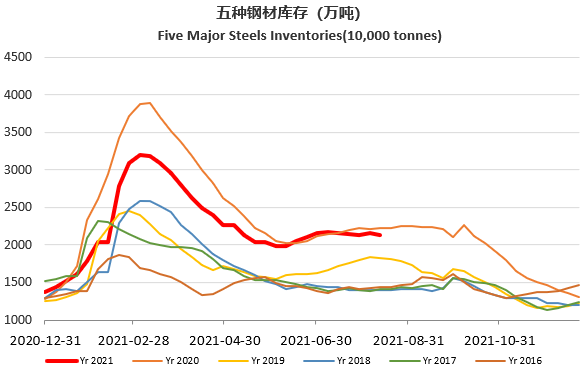

Steel Key Indicators

· CISA: July major steel mills produced 70.06 million tonnes of steels, down 5.61% y-o-y. Crude steel daily production 2.26 million tonnes, down 8.26% y-o-y.

· Ganggu Construction Steel Inventory: production 4.91 million tonnes, down 178,100 tonnes w-o-w. Mills inventory 4.81 million tonnes, down 181,500 tonnes w-o-w. Circulation inventory 10.196 million tonnes, down 33,700 tonnes w-o-w.

Coal Indicators

· Indonesia electronic mills were short of coal inventories. Thus the country require the local suppliers to maintain domestic demand and slow down export.