Market Verdict on Iron Ore:

· Iron ore short-run neutral.

Macro

· U.S. FOMC notes indicated to decrease QE within the year 2021. The attendee of the conference said the inflation was caused by labor and supply chain shortage, which was temporarily. However the cost increase by supply chain breakdown was beyond expectation. The new Delta Virus also potentially cause a delay on the general restart of economy and decrease the labor supply.

· Multiple ports congestion intensified because of the epidemic rebound. Some media indicated this was the biggest crisis in freight industry over the past 65 years, where 353 container vessels were lined up at ports worldwide, which doubled the number from last year. Many old ports maintenance was also a contributor to this congestion.

Iron Ore Key Indicators:

· Platts62 $153.05, -6.45, MTD $168.14.

· BHP said in a strategy report that China demand on iron ore will be lower than current levels in future as the stoppage on crude steel increase as well as increase on scrap usage.

SGX Iron Ore 62% Futures& Options Open Interest (Aug 18th)

· Futures 80,191,000 tonnes(Increase 1,145,100 tonnes)

· Options 71,836,800 tonnes(Increase 351,900 tonnes)

Steel Key Indicators

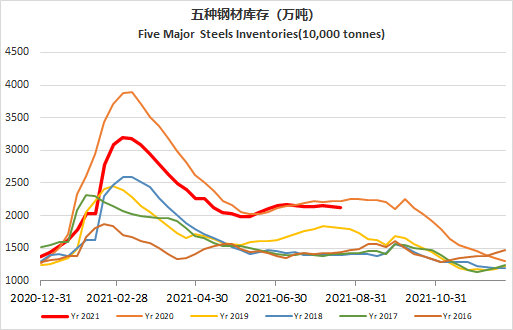

· MySteel Rebar Inventory: Rebar production 3.25 million tonnes, up 1.12% w-o-w. Mills inventory 3.41 million tonnes, up 0.04% w-o-w. Circulation inventory 7.94 million tonnes, down 1.59% w-o-w.

Coal Indicators

· The major Mongolia port export coking coal and prime coal Ganqimaodu, closed today since one truck driver tested positive for Covid-19.

· China Coal Transportation and Distribution Association: China multiple departments granted new coal capacity approval of 150 million tonnes.