Market Verdict on Iron Ore:

· Neutral to bullish

Macro

· S&P 500 and Nasdaq closed on prehistoric high yesterday.

Iron Ore Key Indicators:

· Platts62 $149.45, +0.85, MTD $160.09.

· Brazil Minas Gerais State No. 8 iron ore miner received environment approval by the end of year 2021, and the miner will immediately start iron ore mining construction. The miner expected to produce 27.5 million tonnes of iron ore, owned by Sul Americana De Metais, a subsidiary of Hongqiao China.

SGX Iron Ore 62% Futures& Options Open Interest (Aug 25th)

· Futures 82,577,700 tonnes(Increase 429,700 tonnes)

· Options 83,927,100 tonnes(Increase 582,500 tonnes)

Steel Key Indicators

· Tangshan pig iron cost pre-tax 3584 yuan/tonne, billet cost 4561 yuan/tonne, down 26 yuan w-o-w. The steel margin 389 yuan/tonne, down 64 yuan/tonne.

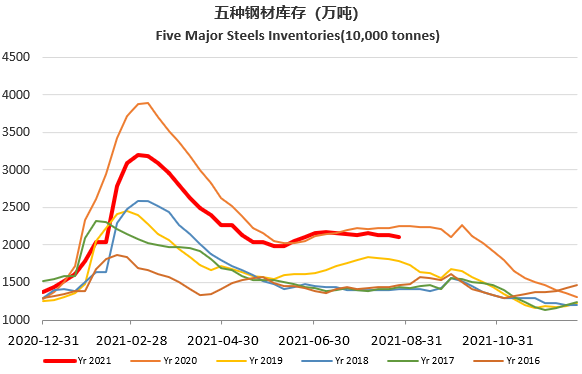

· MySteel Rebar Inventory: Rebar production 3.27 million tonnes, up 0.83% w-o-w. Mills inventory 3.33 million tonnes, down 2.16% w-o-w. Circulation inventory 7.89 million tonnes, down 0.62% w-o-w.

· World Steel Association: 64 member country steel production 161.7 million tonnes, up 3.3% y-o-y.

Coal Indicators

· Mongolia decided to upgrade to orange level, the highest state alert level against the pandemic, expected to end in December 31st.

China NDRC: approved 16 coal miners in Erdos, with 25 million tonnes of capacity on annual basis. In addition, 50 million tonnes capacity expected to be approved in mid- September.