A total of 920,000 mt of iron ores was traded for the week ended Aug 27, down 3.16% week-on-week, despite some price recovery at the end of the week.

Iron ore prices had rebounded as some trade participants believed that the pricing had reached near term bottom, while restocking activities had picked up before the peak season of Sep-Oct construction period.

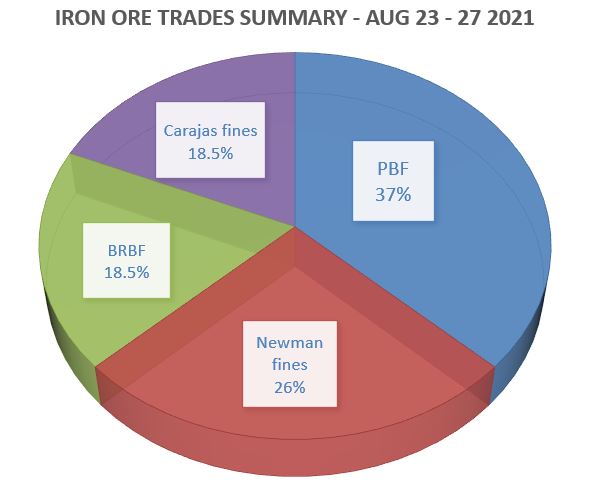

During the week, the trades volume of PBF accounted the largest market share at 37%, then followed by Newman fines at 26%, and Carajas fines at 18.5% too.

PBF demand back for good

Most of the buying interests centered around mainstream medium grade fines like PBF, which had undergone few rounds of price corrections since its heydays during Jun-Jul period.

Thus, some end-users viewed that the prices of mainstream grade fines had reached rock bottom, before better demand kicked in during the traditional peak steel season of Sep-Oct period.

There were also some market concerns over upcoming stringent winter production controls, however there was lower demand for high grade fines and domestic concentrates, due to the recent high coke prices.

Better restocking activities and steel consumptions

This week also witnessed gradual picking up of restocking activities among trade participants, as mills’ steel inventory recorded a decline from better steel consumption.

According to Mysteel, Chinese mills’ steel inventory reached a total of 6.2 million mt as of Aug 25, down 2.6% on-week after surveying a total of 184 Chinese mills.

The lower inventory indicated that steel demand had improved, and there might be more restocking activities ahead to buildup stocks for the upcoming peak season.