Market Verdict on Iron Ore:

· Neutral to bearish, however limited room downside.

Macro

· China August Manufacturing PMI 50.1, est. 50.2, last 50.4. Analysts believed that as the decrease of pandemic cases, and the “busy September” in manufacturing market, PMI potentially recover.

· European central bank decided to end pandemic bond purchase from next March.

Iron Ore Key Indicators:

· Platts62 $152.60, -5.15, AUG AVG 159.25.

· Australian miner FMG sashed term contract widened 3% on the month to 30%, whie FBF dscounts widened 7% on discounts further for September loading cargoes such as Super

Specal Fines, or SSF, and Fortescue Blend Fines, or FBF. SSF discounts the month to 26%, both basis the September average of the IODEX.

· FMG financial report indicated that FY 2021 total shipments 182 million tonnes, a historical high. Total revenue 2.3 billion U.S. dollars, up 74% y-o-y. FY 2021 production guidance at 180 -185 million tonnes, C1 cash cost $15 – 15.5/tonne.

SGX Iron Ore 62% Futures& Options Open Interest (Aug 31th)

· Futures 68,300,800 tonnes(Decrease 17,694,700 tonnes)

· Options 70,906,000 tonnes(Decrease 16,222,100 tonnes)

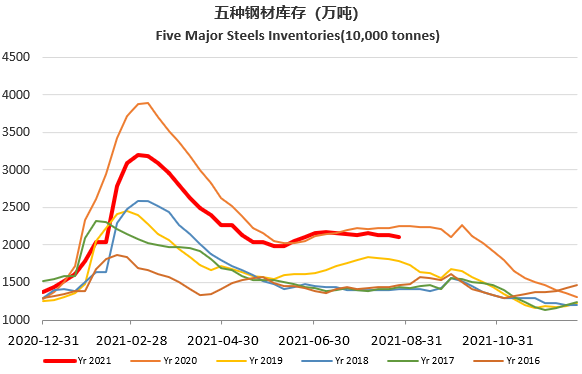

Steel Key Indicators

· Ganggu construction steel production 5.13 million tonnes, up 73,700 tonnes w-o-w. Circulation inventory 10.03 million tonnes, down 92,900 tonnes w-o-w. Mills inventory 4.55 million tonnes, down 236,300 tonnes w-o-w.

Coal Indicators

· Mongolia decided to upgrade to orange level, the highest state alert level against the pandemic, expected to end in December 31st.

· China NDRC organized Inner-Mongolia, Liaoning, Jilin and Heilongjiang provinces to attend meeting to ensure the winter and spring coal supply. The meeting urge to release new capacity.