Market Verdict on Iron Ore:

· Neutral.

Macro

· U.S. ISM announced last month U.S. PMI reached 59.9. However the price indicator of Manufacturing industry dropped from 85.7 to 79.4 from July to August, created the eight month low, which potentially symbolized that inflation reached a roof area.

· Germany central bank indicated that European inflation risk was beyond expectation and infiltrated into major prices. Thus European central bank should consider to end the 1.85 trillion Euro purchase on PEPP.

· On September 1st, the State Food and Material Reserve Bureau released the third batch of national reserves of copper, aluminum and zinc, totaling 150,000 tons.

· Liu Shijin, member of the monetary policy committee of the China Central Bank, said that China’s macro economy may return to a near conventional state in the fourth quarter, the fundamentals of commodity supply and demand have not changed, and the rise in prices is a short-term phenomenon. Fang Xinghai, vice chairman of China Securities Regulatory Commission, said that we should improve the pricing influence of China’s commodity market in the process of expanding opening up economy.

Iron Ore Key Indicators:

· Platts62 $143.55, -9.05.

· Tangshan major mills pre-tax pig iron cost 3585 yuan/tonne, up 6 yuan/tonne. Steel margin 453 yuan/tonne, up 64 yuan/tonne.

SGX Iron Ore 62% Futures& Options Open Interest (Sep 1st)

· Futures 69,622,100 tonnes(Increase 1,321,300 tonnes)

· Options 71,505,000 tonnes(Increase 599,000 tonnes)

Steel Key Indicators

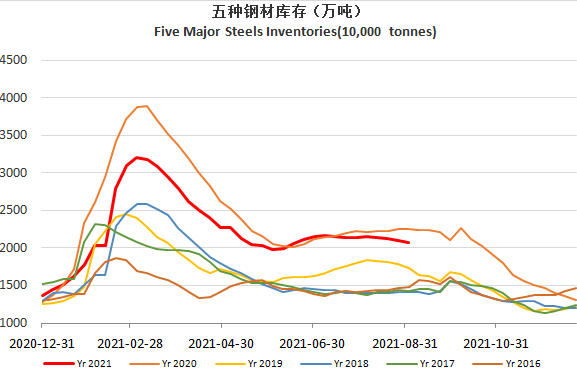

· MySteel Rebar Inventory: Rebar production 3.3459 million tonnes, up 2.2% w-o-w. Mills inventory 3.4 million tonnes, up 2.15% w-o-w. Circulation inventory 7.76 million tonnes, down 1.57% w-o-w.