Market Verdict on Iron Ore:

· Neutral.

Macro

· China National Development of Reform Comission: the H2 specialized local debts were issued significantly higher than previous year to stabilize the investment in infrastructure. The debts were proposed to issue earlier than expected.

· New York Federal chairman Williams expected the year 2022 U.S. inflation rate slow down to 2%. The decrease on debts were appropriate in the year 2021, however depend on the future discussion of Federal. U.S. Treasury Secretary Yellen said the cash payment and special practices expected to be used up in the coming October.

· China August CPI 0.8%, previous 1%, est. 1%. China August PPI 9.5%, previous 9%, est. 9%.

Iron Ore Key Indicators:

· Platts62 $133.05, -4.80, MTD $138.45.

· U.S. Five Lakes area iron ore delivery 5.6 million tonnes in August, up 55.9% y-o-y. Jan-August total iron ore delivery 32 million tonnes, up 31.8% y-o-y.

· Brazil Mining Group signed a new railroad agreement with Brazil infrastructure department, to transport iron ores from Piaui.

SGX Iron Ore 62% Futures& Options Open Interest (Sep 8th)

· Futures 72,658,300 tonnes(Increase 180,700 tonnes)

· Options 82,116,500 tonnes(Increase 4,105,000 tonnes)

Steel Key Indicators

· China Baosteel singed a MOU with Aramco to create a world toppest thick plate steel mills.

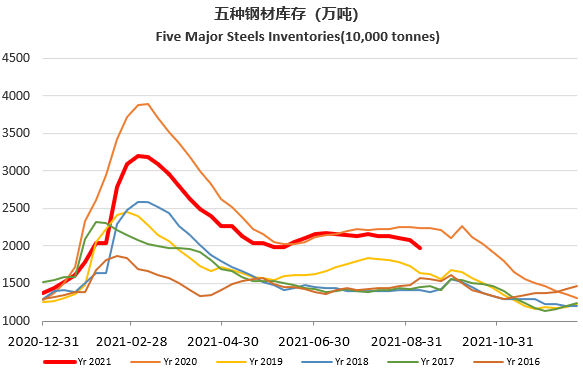

· MySteel Rebar Inventory: Rebar production 3.27 million tonnes, down 2.2% w-o-w. Mills inventory 3.21 million tonnes, down 5.64% w-o-w. Circulation inventory 7.51 million tonnes, down 3.31% w-o-w.

· Tangshan mills pre-tax cost 3654 yuan/tonne, average cost 4664 yuan/tonne, up 97 yuan/tonne w-o-w. Average profits 456 yuan/tonne, up 3 yuan/tonne w-o-w.