Market Verdict on Iron Ore:

· Neutral.

Macro

· European Central Banks announced that the media misrepresented inflation target and interest rate outlook. According to European Central Bank, Euro zone expected to reach 2% inflation rate target, indicating European central bank potential increase interest rate in the coming two years.

· China Environment Bureau published a draft version of Autumn and Winter Air Pollution governance plan: Enforcing the 0 crude steel growth in the year 2021 on the basis of year 2020. Increasing some cities in the list of air pollution control. Standardizing the emission benchmark and inspection in local areas.

Iron Ore Key Indicators:

· Platts 62%: $106.50 (-6.90) MTD $129.40.

· MySteel 45 ports iron ore inventories at 129.75 million tonnes, down 594,600 million tonnes w-o-w. Daily evacuation 2.74 million tonnes, down 90,300 tonnes w-o-w. Australia iron ore 64.15 million tonnes, down 666,900 tonnes w-o-w. Brazil iron ore 40.21 million tonnes, up 1.67 million tonnes w-o-w. 177 ships at ports, down 8.

SGX Iron Ore 62% Futures& Options Open Interest (Sep 16th)

· Futures 75,739,000tonnes(Increase 828,400tonnes)

· Options 89,432,500 tonnes(Increase 1,882,000 tonnes)

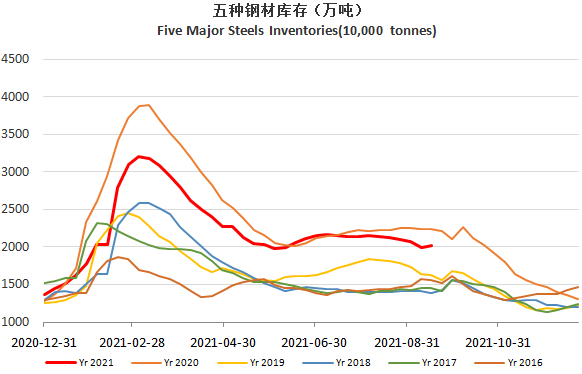

Steel Key Indicators

· Mysteel researched 247 blast furnace operation rate at 71.88%, down 1.69% w-o-w. Utilisation rate 83.74%, down 1.03% w-o-w. Daily pig iron production 2.23 million tonnes, down 27,300 tonnes.

· Seven Jiangsu special steel mill decreased production by 17.51% due to the control on high pollution and high energy consumption.

Coal Indicators

· According to China National Development of Reform Commission, Jan- Aug above designated scale industry electricity generating up 11.3% y-o-y, up 11.6% compared with the year 2019.