Market Verdict on Iron Ore:

· Neutral.

Macro

· China September Total Social Financing reached 2.9 trillion yuan, est. 3.05 trillion yuan, last 2.96 trillion yuan. China September M2 Monetary supply up 8.3% y-o-y, est. 8.2%, last 8.2%.

· U.S. president Biden announced the biggest ports in U.S., Los Angeles port and Long Island Port resumed 24/7 of full day coverage, to resolve the port congestions.

· U.S. FOMC decided to start Taper in mid-November or December. The decrease on buying bonds expected to end in the mid-2022.

Iron Ore Key Indicators:

· Platts 62%: $123.60 (-4.90) MTD $122.48.

· Brazil iron ore miner Amapa was reoperated by Cadence Minerals. The miner expected to deplete in 14 years with annual capacity of 5.3 million tonnes.

SGX Iron Ore 62% Futures& Options Open Interest (Oct 13th)

· Futures 68,250,000 tonnes(Increase 263,200 tonnes)

· Options 83,156,500 tonnes(Increase 200,000 tonnes)

Steel Key Indicators

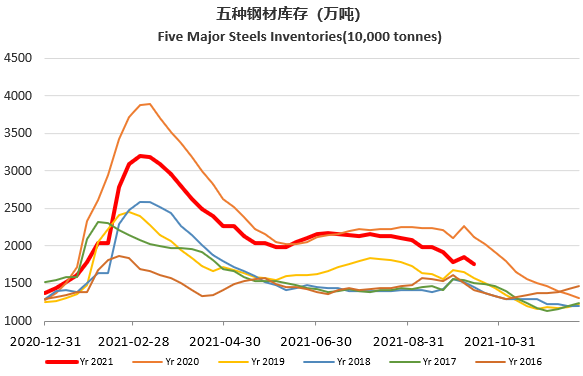

· The winter production curb on steel published recently. Phase I (Nov 15- 31st, 2021)Shandong, Shanxi and Henan provinces are required to total cut 9.69 million tonnes of steel production. Phase II(Jan 1st – Mar 15th), Shandong, Shanxi, Henan, Hebei and Tianjian estimated to cut 33.35 million tonnes.

Coal Indicators

· China State Administration Department indicated that China approved 976 coal miners. 153 miner passed safety test with approximately 55 million tonnes of coal production in this Q4.