Market Verdict on Iron Ore:

· Neutral.

Macro

· China central bank PBOC held a housing and financial market conference to guide major banks managing the housing related finance and maintain a stable and healthy housing market. Evergrande default risk and spillover was in general controllable.

· China National Bureau of Statistics: Q3 GDP up 4.9% y-o-y, Q2 GDP up 7.9% y-o-y. Est. up 5.2% y-o-y. China Q3 above designated scale industry added value y-o-y growth rate 3.1%, last 5.3%, est. 4.5%.

Iron Ore Key Indicators:

· Platts62 $123.50, -0.65, MTD $123.18.SGX iron ore Nov-Dec 21 spread started the second day correction since the priced-in effect of the winter production curb. In addition, current production level wouldn’t trigger any extra production curb to complete the 0 growth rate on crude steel compared to last year.

· Vale Q3 iron ore sales 67.84 million tonnes, Q2 67.22 million tonnes. Q3 production 89.42 million tonnes, up 0.8% y-o-y, Q2 75.69 million tonnes. Vale estimate the year 2021 iron ore production at 315- 335 million tonnes.

· BHP Q3 iron ore total production 70.59 million tonnes, down 3.1% from Q2, down 6.6% y-o-y. BHP expect the FY 2022 iron ore production at 278- 288 million tonnnes.

SGX Iron Ore 62% Futures& Options Open Interest (Oct 18th)

· Futures 71,414,000 tonnes(Increase 912,400 tonnes)

· Options 85,034,000 tonnes(Increase 55,000 tonnes)

Steel Key Indicators

· Shagang started to stop some rolling lines from the night shift of October 19th, rebar production cut 60%, wire rods cut 80%, HRC and CRC currently completely stopped. One blast furnace of HBIS was closed, estimated impact 3,600 tnnes of pig iron without mentioning the total impact time length.

· Major U.S. ex-work HRC down $50 during the week to $2100/tonne, majorly since utilisation rate reached 85%, which was the peak area in U.S. as an average number.

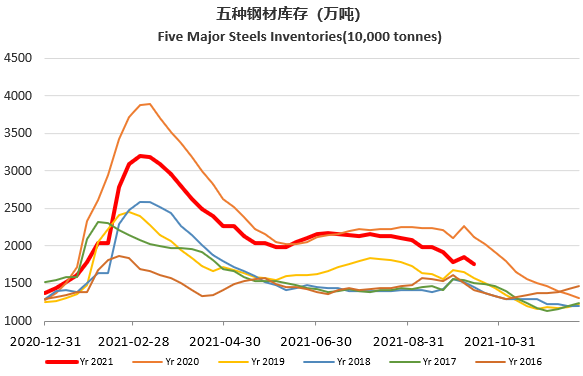

· Ganggu Construction Steel: production 4.6 million tonnes, up 58,800 tonnes w-o-w. Mills inventory 4.35 million tonnes, up 7,300 tonnes w-o-w. Circulation inventory 8.399 million tonnes, down 493,500 tonnes w-o-w.

Coal Indicators

· China NDRC researched in Zhengzhou Commodity Exchange and held conference to enhance surveillance in abnormal price movement as well as punish over-speculation capital and investments.

· China Energy Bureau approved three coal miners in western China, with 6.9 million tonnes of coal production annually.