Market Verdict on Iron Ore:

· Neutral.

Macro

· China CCTV news: U.S. trade representative Katherine Tai seek to ease trade relations with China in a U.S. poultry conference.

· U.S. Q3 GDP up 2% y-o-y, Q2 up 6.7%. The slowing down on GDP growth rate was far beyond expectation.

Iron Ore Key Indicators:

· Platts 62%: $113.15 (-6.5) MTD $121.95. Sep-Dec21 contracts in SGX and DCE Jan22 were weakly consolidated. Because of this winter production curb, the demand shifted to current months instead of year end contract, Nov-Dec 21 maintained higher arround $1.7 compared with spreads across Dec21 – Mar22. The outright contracts expected to become neutral currently since some China domestic mines expected to run at low utilisation rate during winter. Thus encouraged some demands of seaborne sources.

· MySteel 45 ports iron ore inventories at 144.92 million tonnes, up 4.46 million tonnes w-o-w. Daily evacuation 2.89 million tonnes, up 130,600 tonnes w-o-w. Australia iron ore 69.3 million tonnes, up 1.31 million tonnes w-o-w. Brazil iron ore 48.55 million tonnes, up 2.06 million tonnes w-o-w. 190 ships at ports, down 12.

·

SGX Iron Ore 62% Futures& Options Open Interest (Oct 28th)

· Futures 76,013,700 tonnes(Decrease 422,100 tonnes)

· Options 87,685,500 tonnes(Increase 1,231,000 tonnes)

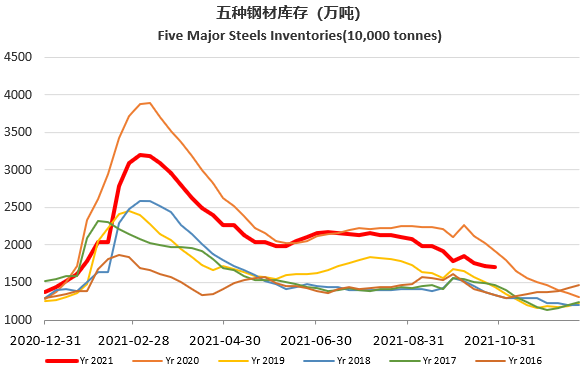

Steel Key Indicators

· Jiangsu 24 steel mills rebar utilisation rate at 60.95%, up 9.18% w-o-w, indicated Jiangsu electricity usage restriction was relaxed.

· Mysteel researched 247 blast furnace operation rate at 74.9%, down 1.66% w-o-w. Utilisation rate 78.83%, down 1.22% w-o-w. Daily pig iron production 2.11 million tonnes, down 348,200 tonnes.

Coal Indicators

· Platts news indicated that some Chinese steel mills have received verbal notices from customs for port clearance of standard Australian coals.

· China 30 sample coke plants average coking profit at 258 yuan/tonne, down 11 yuan/tonne w-o-w.