Market Verdict on Iron Ore:

· Neutral.

Macro

· U.S. FOMC meeting decided the market expected to start Taper during an unchanged interest rate by decreasing 15 billion U.S. dollars of T-Bond purchase per month. U.S. federal believed would support economic activities and jobs, at the same time counter against inflation risk.

· U.S. ADP statistics indicated jobs increased 571,000 in October, est. 400,000, which created the highest since this June.

· Instituite of

Iron Ore Key Indicators:

· Platts62 $99.70, +3.25, MTD $99.82. Singapore holiday on this Thursday. Iron ore futures in both SGX and DCE rebounded from yesterday to today, however the physical volume didn’t saw any significant increase on both ports or seaborne side. However the FOMC sent a dovish signal, which helped industrial sector rebounding during this morning. SGX and DCE iron ore spreads were stable at historical low area currently.

SGX Iron Ore 62% Futures& Options Open Interest (Nov 3rd)

· Futures 64,271,900 tonnes(Increase 1,734,000 tonnes)

· Options 62,364,500 tonnes(Increase 1,190,000 tonnes)

Steel Key Indicators

· Handan started a new round of production curb from Nov 1 – 7th, estimated impact 89,800 tonnes of pig iron production on daily basis.

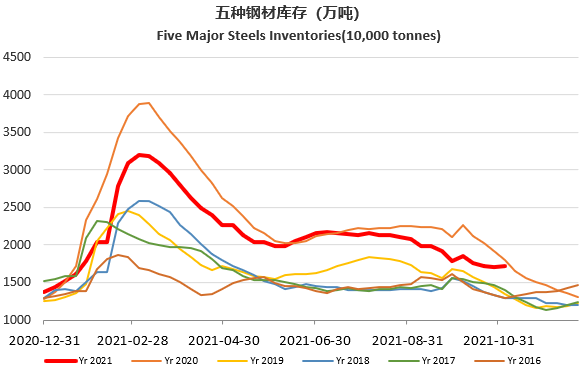

· MySteel Rebar Inventory: Rebar production 2.88 million tonnes, down 0.74% w-o-w. Mills inventory 2.8 million tonnes, up 7.58% w-o-w. Circulation inventory 5.34 million tonnes, down 4.33% w-o-w.

Coal Indicators

· China NDRC revealed many state-owned miners decrease 5500 kcal thermal coal to below 1000 yuan/tonne. NDRC expected market would return to fundamental side in short-run.