Market Verdict on Iron Ore:

· Neutral to bullish.

Macro

· China Evergrande paid interests to bondholders of debts expiring in the year 2022, 2023 and 2024 totaled 148 million U.S. dollars.

· U.S. president Biden indicated control inflation was the most important thing, energy cost increase caused price increase. Biden also required Federal Trade Commission to punish market speculation. U.S. last week jobless filing 267,000, created the lowest of the current two years. Market estimated 260,000, last 269,000.

Iron Ore Key Indicators:

· Platts62 $89.50, -2.95, MTD $95.43. Iron ore rebounded following the strong equity market over late yesterday and early this morning, as well as the Evergrande paid interest of debts, which some macro analysts expected the default risk decreased significantly. Industrial sectors in general rebounded. Iron ore at China northern ports raised offer by 5 yuan/tonne, however expecting higher in the afternoon.

SGX Iron Ore 62% Futures& Options Open Interest (Nov 10th)

· Futures 72,772,600 tonnes(Increase 3,158,600 tonnes)

· Options 65,189,000 tonnes(Increase 919,500 tonnes)

Steel Key Indicators

· BaoSteel decreased HRC price by 300 yuan in early December.

· Tangshan steel mills after-tax cost 4920 yuan/tonne, down 97 yuan/tonne. Steel mills loss at 470 yuan/tonne, down 353 yuan/tonne.

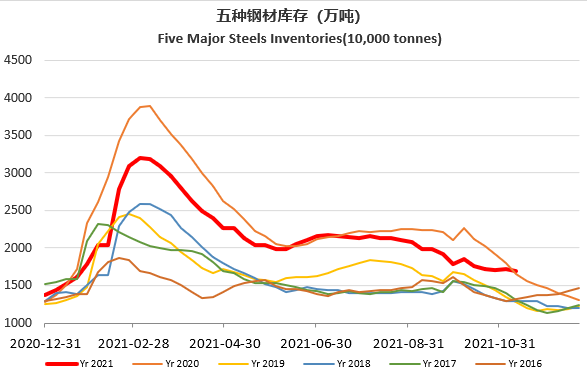

· MySteel Rebar: Rebar production 2.83 million tonnes, down 1.99% w-o-w. Mills inventory 2.86 million tonnes, up 2.08% w-o-w. Circulation inventory 5.02 million tonnes, down 5.93% w-o-w.