Market Verdict on Iron Ore:

· Neutral.

Macro

· China Ministry of Foreign Affairs spokesperson Hua Chunying announced that China Chairman Xi will hold a internet conference with U.S. president Biden. Market understand as a step forward and ease of the two countries.

· 21 China cities published a price floor on houses to avoid a fast drop of house prices and disruption on the market.

Iron Ore Key Indicators:

· Platts62 $89.75, -4.45, MTD $94.66. Iron ore returned to weak trend after a short-run rebound as seaborne resources are pegged tightly with the mills production. Non-production related physical trades almost vanished. Iron ore port inventories grow fast and increased the brands of iron ores, which stressed down significantly the discount iron ores like MACF and JMBF.

SGX Iron Ore 62% Futures& Options Open Interest (Nov 12th)

· Futures 74,657,400 tonnes(Increase 954,800 tonnes)

· Options 63,439,500 tonnes(Decrease 1,739,500 tonnes)

Steel Key Indicators

· China National Bureau of Statistics: October China steel production 101.74 million tonnes, down 14.9% y-o-y. Jan- Oct production 1.12 trillion tonnes, up 2.8% y-o-y. China Jan – Oct crude steel production 877 million tonnes, down 0.7% y-o-y.

· Tangshan steel mills after-tax cost 4920 yuan/tonne, down 97 yuan/tonne. Steel mills loss at 470 yuan/tonne, down 353 yuan/tonne.

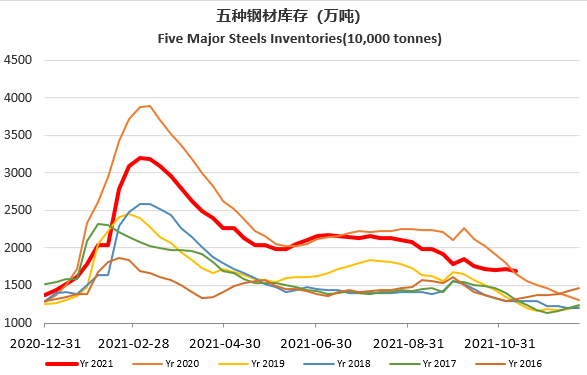

· Steelbank construction steels inventory 4.95 million tonnes, down 8.05% w-o-w. HRC inventories 2.15 million tonnes, up 9.56% w-o-w.

Coal Indicators

· China railroad thermal coal transportation during October reached 157 million tonnes, up 26.8% w-o-w. The thermal coal at power plants inventories useable for 21.8 days, up 7.8 days from late September.