Market Verdict on Iron Ore:

· Neutral to bullish.

Macro

· China PM Li Keqiang held economy conference last Friday emphasizing the practical actions to promote healthy economy and decrease the cost pressure on mid and small capital companies from upstream commodities.

· China Vice PM Liu He said in a manufacturing conference that financial institutes should increase the financing support on manufacturing enterprises.

Iron Ore Key Indicators:

· Platts 62%: $91.30 (+4.10) MTD $92.85. Iron ore seaborne and China port market warmed from the late half of last week. However after the two exciting day with recovery on price and volume, iron ore returned to quiet in Monday morning. Port prices unchanged compared to Friday afternoon this morning. SGX iron ore structure remain stable. DCE iron ore spreads once reached contango, however this special market structure expected to recover to backwardation in 1-2 weeks.

SGX Iron Ore 62% Futures& Options Open Interest (Nov 19th)

· Futures 80,721,100 tonnes(Increase 1,240,900 tonnes)

· Options 71,485,000 tonnes(Increase 565,000 tonnes)

Steel Key Indicators

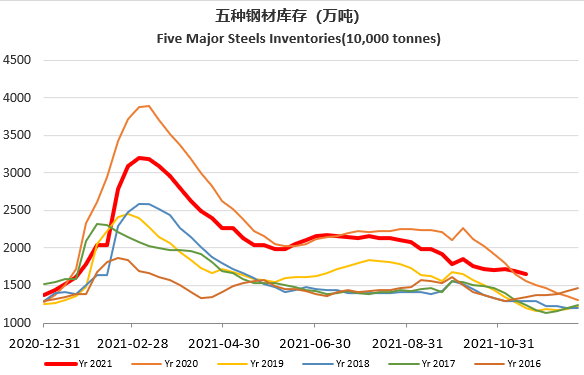

· Steelbank construction steels inventory 4.66 million tonnes, down 5.87% w-o-w. HRC inventories 2.098 million tonnes, down 2.4% w-o-w.

· Jiangsu Shagang Group decided to cut 40% production on rebar from Nov 20- 30th.

Coal Indicators

· China Shandong mills lowered purchase price on coke by 200 yuan/tonne at 3283 yuan/tonne.