Market Verdict on Iron Ore:

· Neutral.

Macro

· China PM Li Keqiang indicated in the conference last Friday that China potentially leverage interest rate decrease policy in different markets to facilitate the healthy environment of investment and liquidity for mid-small enterprises.

· China Evergrande Group officially announced the inability to perform its guaranteed liability. Local government start a discussion with the management team of the company and organize a special work group to help Evergrande resolve the risk.

· U.S. government expected to start a “rebuild better world” infrastructure plan from next January. E.U. commission approved the “Global Gate” program and raised 300 billion Euros to invest in global infrastructures projects.

Iron Ore Key Indicators:

· Platts62 $98.50, +0.15, MTD 99.42. Seaborne market saw very active trading in MACF and PBF during the past week. Dec21-Jan22 SGX iron ore spread once become contango, however not expected to last till the end of the month with a stronger iron ore market. The back spread in the year 2022 also expected to recover deeper backwardation structure in mid-run.

· Following an evaluation of iron ore reveres in accordance with international JORC standards, Metalloinvest determined its economically recoverable iron ore reveres amount to 15.4 billion mt, the largest in the world.

· Trade sources indicated that Vale increase by 8$ in Q1 2022 to $58 on the DR pellets.

SGX Iron Ore 62% Futures& Options Open Interest (Dec 3rd)

· Futures 77,045,200 tonnes(Increase 77,045,200 tonnes)

· Options 54,206,000 tonnes(Increase 1,215,000 onnes)

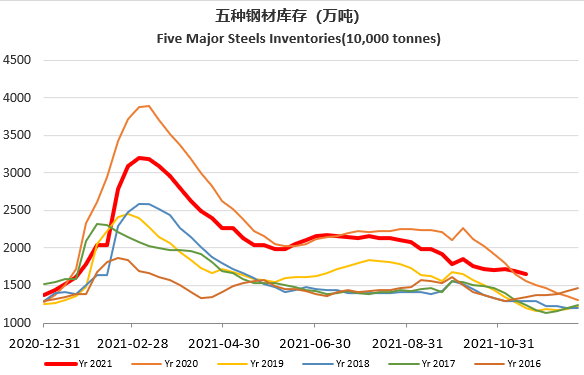

Steel Key Indicators

· China Baosteel indicated the company is current able to cut 30% of carbon emission in the year 2035, and achieve the carbon neutral target in the year 2050.

Coal Indicators

· China Zhengzhou Commodity Exchange changed the thermal coal contract delivery benchmark to better serve the risk management of enterprises.