Market Verdict on Iron Ore:

• Neutral.

Macro

• At a news conference in Brussels, NATO Secretary General Stoltenberg said that NATO had handed over its “written proposal” to Russia, which was carried out simultaneously with the United States. Stoltenberg did not disclose the specific content of the written proposal. NATO believed that there should be improvement between NATO and Russia, European Security, and increasing transparency and strengthening arms control.

• Brent oil refreshed new high above $90/barrel since the year 2014.

• U.S. FOMC maintained interest rate at 0-0.25%, in line with market expectation. However Powell said the asset purchase would end in early March and next interest rate raise potentially happen in March.

Iron Ore Key Indicators:

• Platts 62%: $138.10 (+0.25) MTD $129.21. Discounted medium grade iron ore concentrates continue to attract buying interest and squeeze PBF out of the market. Portside iron ore current became more cost-effective compared with seaborne. In addition, buyers don’t need to take risk on laycan delay or index change.

SGX Iron Ore 62% Futures& Options Open Interest (Jan 26th)

• Futures 91,910,000 tonnes(Increase 939,900 tonnes)

• Options 51,162,800 tonnes(Increase 665,000 tonnes)

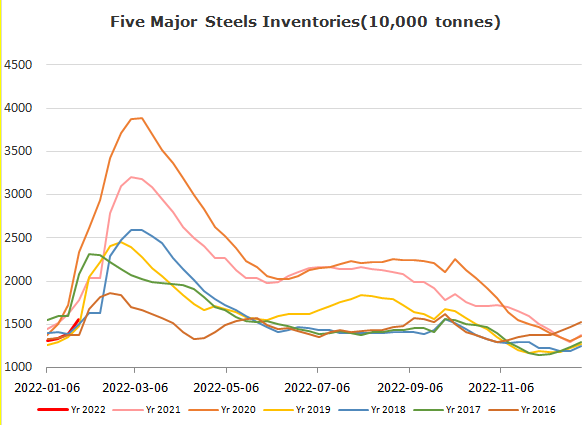

Steel Key Indicators

• Tangshan average steel mills billet cost 4261 yuan/tonne, up 54 yuan/tonne. Steel margin 219 yuan/tonne, up 46 yuan/tonne.

• Mysteel surveyed over 70% of the construction projects in China stopped, estimated the projects stoppage would reach 89% across Chinese New Year.

• World Steel Association statistic indicated that global steel production up 3.7% at 1.95 billion tones including the 64 member countries. China production 86.2 million tones, down 6.8% y-o-y. India produced 10.4 million tones, up 0.9%. Japan produced 7.9 million tones, up 5.4% y-o-y. U.S. produced 7.2 million tones, up 11.9% y-o-y. Russia unchanged at 6.6 million tones. Korea produced 6 million tones, up 1.1% y-o-y. Germany produced 3.1 million tones, up 0.1% y-o-y.

Coal Indicators

• China coke plants planned to increase 18.63 million tones of cokes capacity, however potentially delay to Q2 because of some regional policy changes and CDQ facility installation.