Market Verdict on Iron Ore:

· Neutral.

Macro

· U.S. Five-Year Treasury Bond up 6 basis point yesterday and breakthrough 2% first time for the previous six years. Ten-Year Treasury bond also reached 2.05%. Forex traders believed that there would be seven interest rate increase for the year 2022 and expected 80% possibility for interest rate increase in the next six times.

Iron Ore Key Indicators:

· Platts62 $144.90, -9.60, MTD $153.32. The spread between onshore ports and seaborne maintain wide, seaborne corrected as the thin buying interests last week. The major seaborne trades were concentrated in the heavy discount iron ores, for example MACF, JMBF or Yandi Fines. As Chinese steel margin narrows, SP10 fines and SSF are also becoming popular on ports. Ukraine miners were running at only 50% utilization rate. Pellets export to China has been disrupted, however Chinese mills are more reliable on domestic pellets since domestic miners recovered to normal production. Chinese mills also concerning the Ukraine pellets had become less cost-effective as well as laycans deterred.

· Iron ore global delivered 25.44 million tons, down 3.59 million tons w-o-w. Australia delivered 16.4 million tons of iron ores, up 726,000 tons w-o-w. Brazil delivered 4.275 million tons of iron ores, down 2.496 tons w-o-w. Mid and small miners delivered 4.76 million tons, down 1.82 million tons w-o-w.

SGX Iron Ore 62% Futures& Options Open Interest (Mar 14th)

· Futures 88,836,700 tonnes(Increase 1,039,700 tonnes)

· Options 84,491,300 tonnes(Increase 925,000 tonnes)

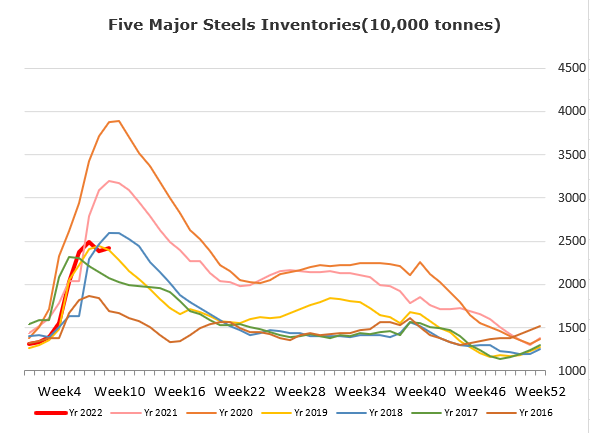

Steel Key Indicators

· The pig iron production utilization rate expected to reach 78.92% in Tangshan area, up 21.6% w-o-w.

· China National Bureau of Statistics: January – February(2022) China pig iron production 132.12 million tons, down 10.8% y-o-y. Crude steel 157.96 million tons, down 10% y-o-y. Finished steel 196.71 million tons, down 6% y-o-y.

Coal Indicators

· Australia premium low coking coal FOB price keep refreshing historical highs, because the big spike on the steel price in European market which support the demand of coking coals. However CFR China was decreasing because the new round of pandemic expected to hurt the demand market in current few weeks.