Market Verdict on Iron Ore:

• Neutral.

Macro

• China and U.S. held an internet conference during the tight worldwide political conditions in the first quarter of the year 2022. Although both countries have different views on the Russia-Ukraine war, however both countries thought the talk was “constructive” and mentioned to improve the cooperation in future. Market believed that the discussion could be a signal of warming relations between China and U.S.

Iron Ore Key Indicators:

• Platts62: $151.35, +4.45, MTD $150.89. China Shandong portside steel mills have transportation issues caused by Omicrown spread. Drivers need a 48 hours nucleic negative reports to enter the port areas. Lump demand is replaced by the active portside concentrates. Low grade and heavy discount fines such as SSF gathered more buying interests compared with mid-grade. MACF discount widened $1.2 to $8.5 because of inventory grew on ports.

• Brazil’s Labor Court ordered Vale to remove 359 workers from risk area located in Pera Jusante dam, in Parauapebas city, in Para state, according to a Labor prosecutor’s statement. However Vale indicated that no direct impact to iron ore production in Carajas area.

SGX Iron Ore 62% Futures& Options Open Interest (Mar 18th)

• Futures 89,874,500 tonnes(Decrease369,700 tonnes)

• Options 87,086,300 tonnes(Increase210,000 tonnes)

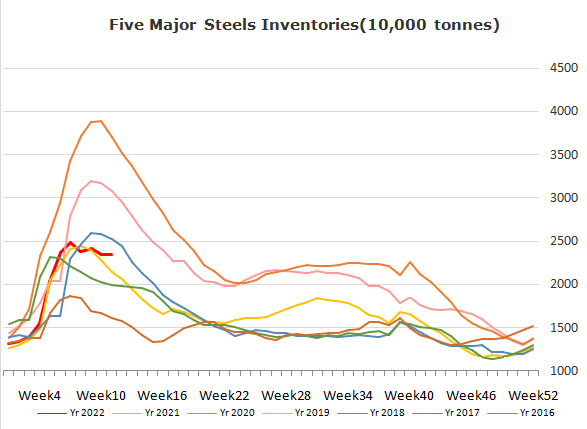

Steel Key Indicators

• Arcelor Mittal increased HRC price by 100 €/ton to 1400 €/ton. European steel mills expected market price to reach 1600 €/ton next week.

• China National Bureau of Statistics indicated that China January to February crude steel production reached 157.96 million tons, down 10% y-o-y.

Coal Indicators

• Australia premium low coking coal FOB price kept stable over the late half of last week. The supply on laycans after two months are relaxed, however the market was still very tight in the current few weeks. March22/Jun22 spread expanded from $110 in the first trading day of March to $170 last week.

• China National Bureau of Statistics indicated that China January to February coal production reached 686.596 million tons, up 10.3% y-o-y.