Market Verdict on Iron Ore:

• Neutral.

Macro

• China NDRC and NEA(National Energy Administration) planned to reach 4.6 billion tons equivalent of sta

• On March 22, Chinese National Development and Reform Commission and the National Energy Administration issued the “14th five year plan” for modern energy system. By 2025, the annual comprehensive production capacity of domestic energy will reach an equivalency to 4.6 billion tons of standard coal, the annual output of crude oil will rise and stabilize at the level of 200 million tons, and the annual output of natural gas will reach more than 230 billion cubic meters.

Iron Ore Key Indicators:

• Platts62 $143.50, -4.40, MTD $150.24. Iron ore extended loss for the second day with no interest on seaborne market. A strip tender of PBF heard floating around on March 22nd for shipments from May to October 2022 with a laycan/month. Portside activity remain healthy. Rio Tinto exports jumped by 18.13% w-o-w to 5.94 million mt. Weekly average was 5.4 million over the previous four weeks. BHP shipments reached 4.73 million mt down 19.1% w-o-w. The previous four weeks average volumes were 5.12 million mt. Vales volumes up 59.61% to 5.29 million mt from Brazil ports. The weekly average shipments were 4.4 million mt over the previous four weeks. FMG volumes increased by 21% to 3.29 million mt, prevoius four weeks avreage volumes were 3.24 millon mt.

• MySteel 45 port previous week iron ore arrived 21.93 million tonnes, up 929,000 tonnes w-o-w. Northern six ports arrivals at 10.23 million tonnes, up 281,000 tonnes w-o-w.

SGX Iron Ore 62% Futures& Options Open Interest (Mar 22nd)

• Futures 90,766,200 tonnes(Increase 423,300 tonnes)

• Options 87,943,800 tonnes(Increase 35,000 tonnes)

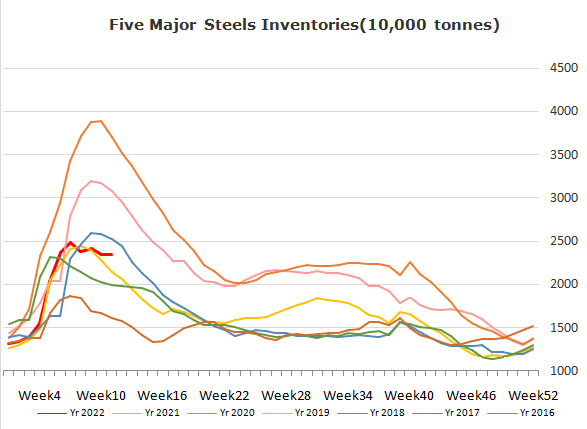

Steel Key Indicators

• China Tangshan implemented temporary whole area close-management from today.

• CISA statistic indicated that the February 2022 global crude steel production down 5.7% y-o-y to 142.7 million tons.

Coal Indicators

• Australia premium low coking coal FOB price kept stable over the late half of last week. The supply on laycans after two months are relaxed, however the market was still very tight in the current few weeks. As Shanxi coking coal delivery was blocked by the virus spread which decreased the demand from steel makers, plus Mongolia export coking coal increased, the current coking coal supply in China is becoming relax.