Market Verdict on Iron Ore:

• Neutral.

Macro

• European gas prices soared 34%. Earlier, Putin said that the supply of natural gas to European countries would be settled in rubles.

• China machinery excavators March sales number reached 40,000, down 49% y-o-y, down 36% compared with February.

• The office of the U.S. trade representative said on March 23rd local time that it would resume tariff exemption for some Chinese imports. The tariff exemption involves 352 of the previous 549 pending products. This provision will apply to goods imported from China between October 12, 2021 and December 31, 2022.

Iron Ore Key Indicators:

• Platts62 $146.45, +2.95, MTD $150.01. Iron ore portside activity remain healthy. Worsened COVID-19 situations in China interrupted the supply chains, some mills have difficulties both on buying raw materials and delivering finished steel. Rio Tinto exports jumped by 18.13% w-o-w to 5.94 million mt. Weekly average was 5.4 million over the previous four weeks. BHP shipments reached 4.73 million mt down 19.1% w-o-w. The previous four weeks average volumes were 5.12 million mt. Vales volumes up 59.61% to 5.29 million mt from Brazil ports. The weekly average shipments were 4.4 million mt over the previous four weeks. FMG volumes increased by 21% to 3.29 million mt, prevoius four weeks avreage volumes were 3.24 millon mt.

• MySteel 45 port previous week iron ore arrived 21.93 million tonnes, up 929,000 tonnes w-o-w. Northern six ports arrivals at 10.23 million tonnes, up 281,000 tonnes w-o-w.

SGX Iron Ore 62% Futures& Options Open Interest (Mar 23rd)

• Futures 91,047,200 tonnes(Increase281,000 tonnes)

• Options 88,801,300 tonnes(Increase857,500 tonnes)

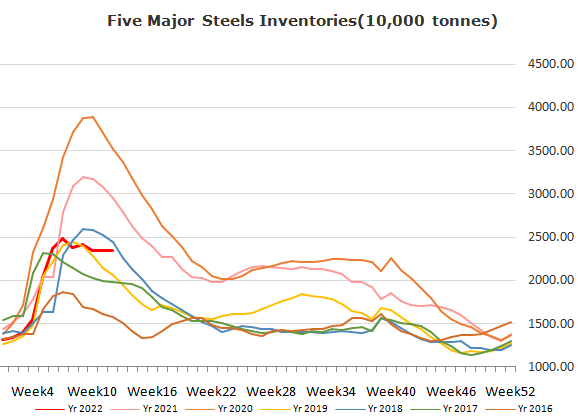

Steel Key Indicators

• Tangshan billet cost 4521 yuan/ton, up 10 yuan/ton w-o-w. Profit margin 229 yuan/ton, up 80 yuan/ton w-o-w.

Coal Indicators

• Australia premium low coking coal FOB price kept stable over the late half of last week. The supply on laycans after two months are relaxed, however the market was still very tight in the current few weeks. As Shanxi coking coal delivery was blocked by the virus spread which decreased the demand from steel makers, plus Mongolia export coking coal increased, the current coking coal supply in China is becoming relax.