Market Verdict on Iron Ore:

• Neutral.

Macro

• European gas prices soared 34%. Earlier, Putin said that the supply of natural gas to European countries would be settled in rubles.

• The United Nations Conference on Trade and Development expected that the prospects for global economic growth will deteriorate this year. The report shows that affected by the conflict between Russia and Ukraine and the changes in macroeconomic policies of various countries in recent months, the United Nations Conference on Trade and Development lowered the global economic growth forecast in year 2022 from 3.6% to 2.6%.

• The office of the U.S. trade representative said on March 23rd local time that it would resume tariff exemption for some Chinese imports. The tariff exemption involves 352 of the previous 549 pending products. This provision will apply to goods imported from China between October 12, 2021 and December 31, 2022.

Iron Ore Key Indicators:

• Platts62 $146.35, -0.10, MTD $149.81. Iron ore portside was weak yesterday with one laycan of MACF traded at $134.6/mt in early April loading. Last Thursday an MACF laycan was traded higher at $137/mt loading in late April. The lack of mobility in labor market as well as transportation disruption on both steels and iron ores resisted the both demand and supply market for raw materials.

• MySteel 45 ports iron ore inventories at 155.18 million tonnes, up 206,300 tonnes w-o-w. Daily evacuation 2.64 million tonnes, down 82,300 tonnes w-o-w. Australia iron ore 74.39 million tonnes, down 284,000 tonnes w-o-w. Brazil iron ore 51.54 million tonnes, up 467,300 tonnes w-o-w. 127 ships at ports, up 6.

SGX Iron Ore 62% Futures& Options Open Interest (Mar 24th)

• Futures 91,586,500 tonnes(Increase539,300 tonnes)

• Options 89,086,300 tonnes(Increase285,000 tonnes)

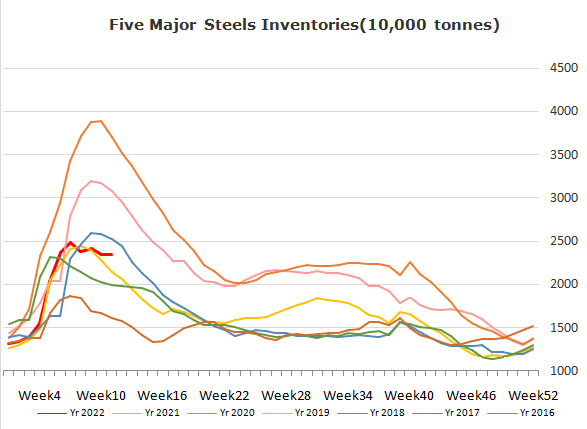

Steel Key Indicators

• Compared with 2020, the steel output of key enterprises in China decreased by 0.23% and the total energy consumption decreased by 1.43% in 2021, indicating that great progress has been made in energy conservation in the industry. In 2021, the comprehensive energy consumption per ton of steel will be 550.43 kg of standard coal, 0.22 kg higher than that in 2020; The comparable energy consumption is 486.55 kg of standard coal, a decrease of 0.79% over 2020; In 2021, the iron steel ratio of China’s key enterprises was 0.8745, down 0.0131 from 2020, which is an important reason for the increase of comprehensive energy consumption per ton of steel.

Coal Indicators

• Australia premium low coking coal FOB price kept stable over the late half of last week. The supply on laycans after two months are relaxed, however the market was still very tight in the current few weeks. As Shanxi coking coal delivery was blocked by the virus spread which decreased the demand from steel makers, plus Mongolia export coking coal increased, the current coking coal supply in China is becoming relax.