Market Verdict on Iron Ore:

• Neutral.

Macro

• China Central Bank held a press conference on financial statistics in the first quarter of 2022. Sun Guofeng, director of the Monetary Policy Department said that monetary policy tools such as RRR reduction should be used in a timely manner to further strengthen financial support for the real economy. The weakening of housing market demand enable banks in more than 100 cities across the country independently lowering mortgage interest rates in an average range of 20 to 60 basis points.

• The U.S. Fed shift to the hawkish to accelerate raising interest rates by 50 basis points in May. The European central bank confirmed the end of the asset purchase plan in the third quarter. It is reported that officials are reaching a consensus on raising interest rates by 25 basis points in the third quarter.

Iron Ore Key Indicators:

• Platts62 $152.80, +1.40, MTD $156.10. Seaborne liquidity continue to remain thin. PBF has none bid at all even physical traders try to lower the offer, since bids were testing the affordability of offers on seaborne cargoes. MACF inventories improved significantly on northern ports, still markets were very willing to buy both on ports as well as fixed price from seaborne market. Spreads between 65 and 62 narrowed market expect the spread continue to narrow in the next few weeks due to the cost saving strategy from steel mills.

• MySteel 45 ports iron ore inventories at 148.73 million tonnes, down 3.83 million tonnes w-o-w. Daily evacuation 3 million tonnes, down 11,400 tonnes w-o-w. Australia iron ore 71.28 million tonnes, down 2.79 million tonnes w-o-w. Brazil iron ore 48.96 million tonnes, down 720,000 tonnes w-o-w. 104 ships at ports, down 2.

SGX Iron Ore 62% Futures& Options Open Interest (Apr 14th)

• Futures 81,202,900 tonnes(Increase840,400 tonnes)

• Options 82,958,500 tonnes(Increase 95,000 tonnes)

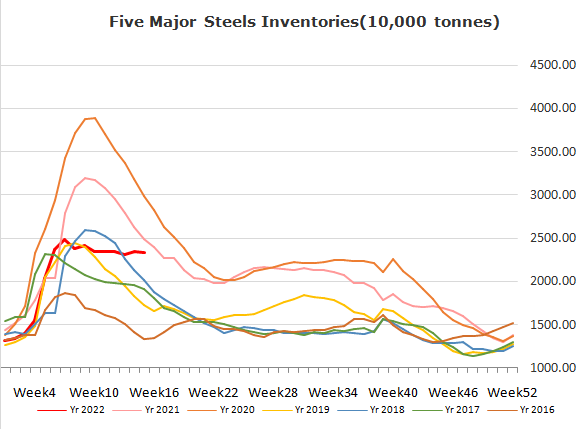

Steel Key Indicators

• China steel export orders increased massively in February and March, market expect the export reaching peak level in April and May, and start to drop in the June. Mysteel expected the steel export reached 18 million in the second quarter of the year 2022, net export expected to reach 14.5 million tons.

• Mysteel researched 247 blast furnace operation rate at 80.11%, up 0.84% w-o-w. Utilisation rate 86.42%, up 1.48% w-o-w. Daily pig iron production 2.33 million tonnes, up 39,800 tonnes.

Coal Indicators

• On April 14, Daqin Railway slipped away and collided with trucks incidents, resulting in 17 trucks off the line, of which 11 fell under the railway bridge and the interruption of Daqin Railway, no casualties. The railway department sent six rescue trains and nearly 1000 staff to the scene to carry out rescue work from both ends of the truck, ease the vehicles in the section, recover the vehicles off the line, and rush through the line as soon as possible. Daqin railway was the biggest coke and coal transportation line in China linking western miners and northern steel mills.