Market Verdict on Iron Ore:

• Neutral.

Macro

• Russian Ministry of Finance indicated the average price of Urals crude oil was $79.81 per barrel to $582.6 per barrel. Russian oil export tariff has been reduced by $11.6 to $49.6 per ton since May 1, 2022. The Iraqi oil minister said OPEC promised to provide oil to fill the crude oil shortage globally. Gazprom continued to deliver natural gas to Europe through Ukraine, with a volume of 57.2 million cubic meters in April 16.

Iron Ore Key Indicators:

• PBF has none bid at all even physical traders try to lower the offer, since bids were testing the affordability of offers on seaborne cargoes. MACF inventories improved significantly on northern ports, still markets were very willing to buy both on ports as well as fixed price from seaborne market. Some Chinese traders expect the JMBF and MACF discount would narrow in next few weeks as structurally demand growth. Spreads between 65 and 62 narrowed market expect the spread continue to narrow in the next few weeks due to the cost saving strategy from steel mills.

Steel Key Indicators

• MySteel researched 85 independent EAFs at average operation rate at 69.22%, up 1.91% w-o-w, down 13.28% y-o-y.

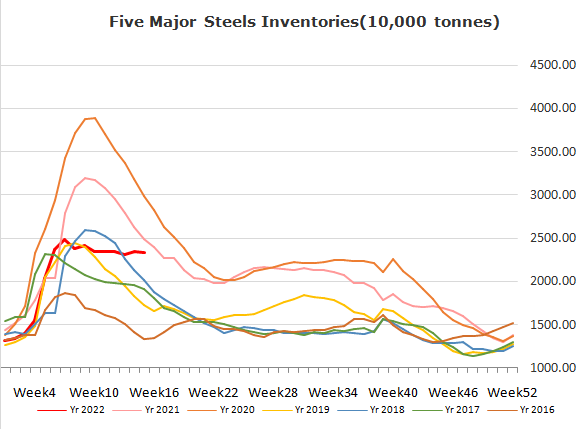

• Steelbank construction steels inventory 7.91 million tons, down 2.61% w-o-w. HRC inventories 3.05 million tons, up 0.87% w-o-w.

Coal Indicators

• China most important coal transportation line Daqin railway recovered normal operation from April 15th, after the truck accidents previously.

• Indonesia increased royalty fees from 13.5% to 14% on local coal miners, which would calculated in the coal export price.