Market Verdict on Iron Ore:

• Neutral.

Macro

• China first quarter GDP 4.8%, est. 4.2%, fourth quarter GDP at 4.0% in 2021.

• World bank set up global GDP growth rate target at 3.2%, previously 3.2%.

• The U.S. Fed shift to the hawkish to accelerate raising interest rates by 50 basis points in May. The European central bank confirmed the end of the asset purchase plan in the third quarter. It is reported that officials are reaching a consensus on raising interest rates by 25 basis points in the third quarter.

Iron Ore Key Indicators:

• Platts62 $153.85, +1.05, MTD $155.90. PBF has none bid at all even physical traders try to lower the offer, since bids were testing the affordability of offers on seaborne cargoes. MACF inventories improved significantly on northern ports, still markets were very willing to buy both on ports as well as fixed price from seaborne market. Some Chinese traders expect the JMBF and MACF discount would narrow in next few weeks as structurally demand growth. Spreads between 65 and 62 narrowed market expect the spread continue to narrow in the next few weeks due to the cost saving strategy from steel mills.

SGX Iron Ore 62% Futures& Options Open Interest (Apr 18th)

• Futures 81,588,600 tonnes(Increase 210,700 tonnes)

• Options 83,223,500 tonnes(Increase 265,000 tonnes)

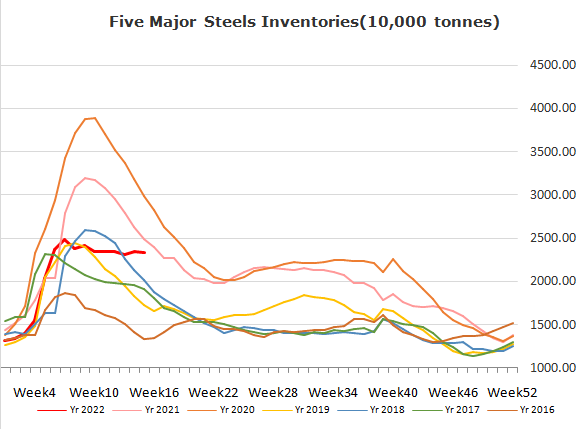

Steel Key Indicators

• China Tangshan area started regionally lockdown started from the 19th of April. A day earlier four areas of Tangshan started a complete lockdown, contributing 49.95% steel capacity of Tangshan, equal to 191,200 tons of pig iron production.

• China NDRC set up a target to ensure the crude steel production decrease in the year 2022.

Coal Indicators

• Wangjialing staff living area suffered a fire accident in China Coal Group. The related miners closed down, accounted for 12.2 million tons of annual capacity. The miner indicated the impact on coal production should be less than 90,000 tons considering the accident was not a directly related to production.