Market Verdict on Iron Ore:

• Neutral.

Macro

• China Loan Prime Rate at 1 year unchanged at 3.7%, est. 3.65%, last 3.7%. Five-year LPR at 4.6%, est. 4.55, last 4.6%.

• U.S. Federal official Mary Darly indicated that the 50 basis points interest rate increase was “very possible” in May. U.S. Federal potentially to raise interest rate to a neutral level.

• Germany Annalena Baerbock announced that Germany would stop importing Russian crude oil from next year during her visit to Baltic countries.

Iron Ore Key Indicators:

• Platts62 $150.70, +0.85, MTD $155.03. PBF has none bid at all even physical traders try to lower the offer, since bids were testing the affordability of offers on seaborne cargoes. MACF inventories improved significantly on northern ports, still markets were very willing to buy both on ports as well as fixed price from seaborne market. Some Chinese traders expect the JMBF and MACF discount would narrow in next few weeks as structurally demand growth. Spreads between 65 and 62 narrowed market expect the spread continue to narrow in the next few weeks due to the cost saving strategy from steel mills.

• BHP Q1 iron ore production 59.7 million tons, down 10% from last Q4, up 1% y-o-y. BHP maintained the FY2021 production target at 249 -259 million tons unchanged from previous prediction.

• Vale Q1 concentrates production 63.92 million tons, down 22.5% from last Q4, down 6% y-o-y. However Vale remained previous production target from 320 -335 million tons in the year 2022.

• Rio Q1 Pilbara iron ore production 71.7 million tons, down 6% y-o-y. maintained unchanged for the yearly production guidance at 320 -325 million tons.

SGX Iron Ore 62% Futures& Options Open Interest (Apr 20th)

• Futures 82,125,600 tonnes(Increase 524,200 tonnes)

• Options 83,884,500 tonnes(Increase 290,000 tonnes)

Steel Key Indicators

• China Tangshan area billet cost 4814 yuan/ton, up 41 yuan/ton. Average profit 16 yuan/ton, up 9 yuan/ton.

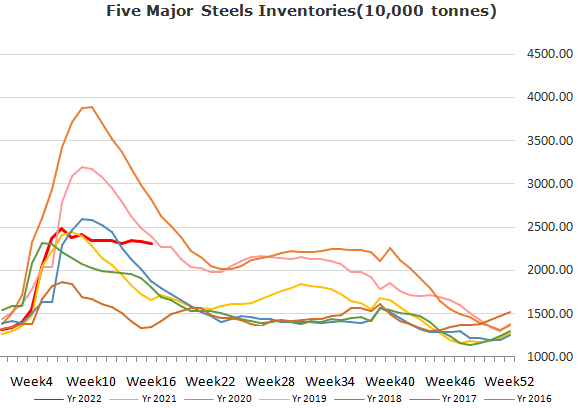

• MySteel Rebar Inventory: Rebar production 3.07 million tonnes, down 0.09% w-o-w. Mills inventory 3.35 million tonnes, up 1.49% w-o-w. Circulation inventory 9.25 million tonnes, down 1.81% w-o-w.

Coal Indicators

• China Hebei Shandong steel mills coke price increased 200 yuan/ton for the sixth rounds, accumulated up 1200 yuan/ton.