Market Verdict on Iron Ore:

• Neutral.

Macro

• Biden said White House could drop Trump Tariffs on China started in 2018 to lower consumer prices and fight inflation in U.S.

• China NDRC and other four departments jointly sent notice to lower the enterprise cost in 2022 and strengthen commodity market supervision.

• China Automobile Commission statistic indicated that April auto sales 1.04 million units, down 35.5% y-o-y, down 34% m-o-m under the impact of pandemic. The April sales data and growth rate refreshed historical low.

• China April CPI 2.1%, est.2%, last 1.5%. China April PPI 8%, est. 7.8%, last 8.3%.

Iron Ore Key Indicators:

• Platts62 $128.10, -3.25, MTD $137.43. Seaborne iron ores such as PBF saw several interests based on sales with discount. However weak steel margins also limited the size of deals. Physical traders indicated that market was interested in FMG SSF as well as some low grade Indian fines. Buyers would be interested on discounted PBF however not accepting moderate premium.

SGX Iron Ore 62% Futures& Options Open Interest (May 10th)

• Futures 74,327,600 tons(Increase 742,300 tons)

• Options 71,944,500 tons(Increase 1,322,500 tons)

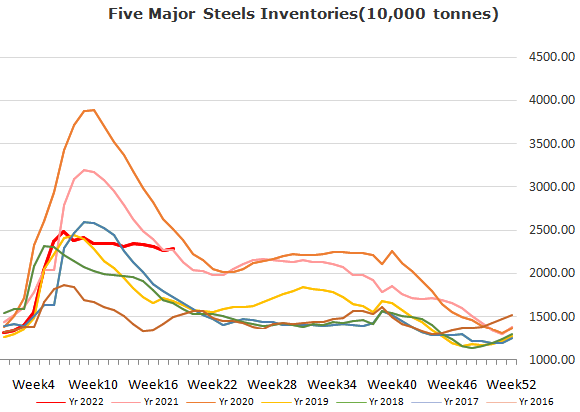

Steel Key Indicators

• CISA: member steel mills produced 2.36 million tons of crude steel on daily basis in late April, up 5.5% from mid-April. Produced 2.04 million tons of pig iron, up 4.35% from mid-April.

Coal Indicators

• China Shanxi coking coal corrected for two rounds in current two weeks totaled 400 yuan/ton.