Market Verdict on Iron Ore:

• Neutral.

Macro

• U.S. Federal chairman Powell indicated that the FOMC supported the 50 basis points interest increase in the next two meetings. Market was pricing in the expectation.

Iron Ore Key Indicators:

• Platts62 $130.15, +2.80, MTD $133.97. Seaborne PBF obtained growing interests, in particular after price correction. However buyers are still preferring MACF. China MACF at port areas decreased fast. South Flank mines expected to ship more MACF to China. 65-62 spread remained narrow around $23 because of the thin steel margin. Some traders indicated that mills resold Carajas fine considering the cost. SSF discount narrowed for consecutive months while SSF/PBF ratio also narrowed, indicating the low grade fines are favorable options for end-users to optimise cost-efficiency.

• Vale indicated that 100 million iron reo capacity was in the process of recovery with starting of multiple new built projects. Vale expect the annual capacity in 2023 would reach 400 million tons.

SGX Iron Ore 62% Futures& Options Open Interest (May 17th)

• Futures 76,728,100 tons(Increase536,100 tons)

• Options 74,271,500 tons(Increase 698,500 tons)

Steel Key Indicators

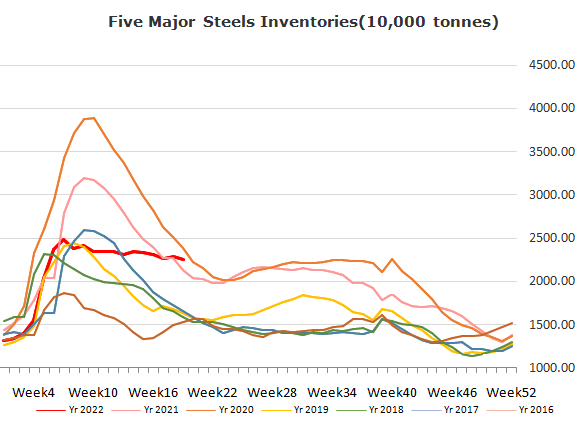

• Ganggu construction steels 4.77 million tons, up 3.52% w-o-w. Mills inventory 5.69 million tons, up 2.94% w-o-w. Circulation 10.96 million tons, up 3.79% w-o-w.

Coal Indicators

• ArcelorMittal didn’t award the bids during yesterday, although buyers attempted to increase bids several times. Eastern Australia rain potentially impact the delivery of coals and port operation.