Market Verdict on Iron Ore:

• Neutral.

Macro

• Shanghai government issued a note to accelerate economy recovery including 50 rules of financial relief. Cancel “white list on resumption” and restrictions of work resumption from June 1st. Allocate a one-time 10,000 yuan subsidy on replacement from fuel vehicles to new energy vehicles. Implement the household appliances trade in program.

• European Union nations failed to agree on a deal Sunday on a revised package of sanctions over Moscow’s invasion of Ukraine ahead of a leaders’ summit in Brussels but talks will continue during the week.

Iron Ore Key Indicators:

• Platts62 $134.45, +3.20, MTD $133.15. Seaborne PBF gathered interests after import margin improved significantly. Iron ore seaborne trades significantly increased on last Friday. Rio Tinto sold two laycans of Fe61% PBF on fixed price. BHP sold two laycans of discounted JMBF. However steel mills margin was in 0 area, the marginal profit of some northern mills were even negative, which resist the big spike of current materials in mid-run level.

SGX Iron Ore 62% Futures& Options Open Interest (May 27th)

• Futures 82,689,300 tons(Increase 1,136,200 tons)

• Options 84,486,000 tons(Increase6,782,500 tons)

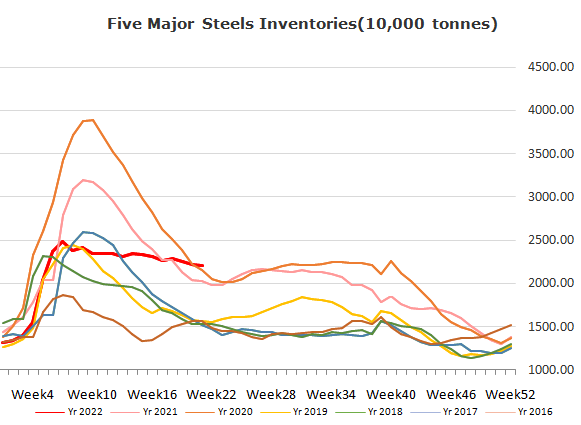

Steel Key Indicators

• China 247 steel mills blast furnace operation rate 83.83%, up 0.82% w-o-w. Utilisation rate 89.26%, up 0.59% w-o-w.

Coal Indicators

• Indian Energy Bureau indicated that the import coals were used to generate electricity. India imported coal first time from 2015.

• The inverse correlation between PLV and PCI raised concerns on physical traders, relative high PCI price was believed unsustainable with alternatives for example low vol HCC, or thermal coals.