Market Verdict on Iron Ore:

• Neutral.

Macro

• World Bank decreased global economy growth rate by 1/3 to 2.9%. The institute indicated that the growth rate in 2023 and 2024 potentially stay on this level.

• Russia is recovering oil export from the port Kozmino by 20%, to satisfy demand from Asian buyers and offset the impact from Europe sanctions.

Iron Ore Key Indicators:

• Platts62 $147.25, +0.50, MTD $143.57. Seaborne PBF gathered interests after import margin improved significantly. Iron ore seaborne trades significantly increased on previous two weeks. Rio Tinto sold quite a few laycans of Fe61% PBF on fixed price. BHP sold JMBF discount at $9-10. However steel mills margin was in 0 area, the marginal profit of some northern mills were even negative, which resist the big spike of current materials in mid-run level. Virtual steel margin was squeezed to extreme low area because iron ore increased faster than steel. As a result, buying interests from China end-users shift from mid-grade to low grade including Robe River Fines and Super Special Fines. There was higher offer on PBF at + $2.8 based on July Platts62 Index, however no bids showing on the market.

• India domestic steel price collapsed after imposed steel export tariff, iron ore auctions slumped 20% recently. NMDC corrected its iron ore price by 25% in two weeks.

SGX Iron Ore 62% Futures& Options Open Interest (Jun 6th)

• Futures 75,786,100 tons(Increase2,537,400 tons)

• Options 73,723,500 tons(Increase 1,633,000 tons)

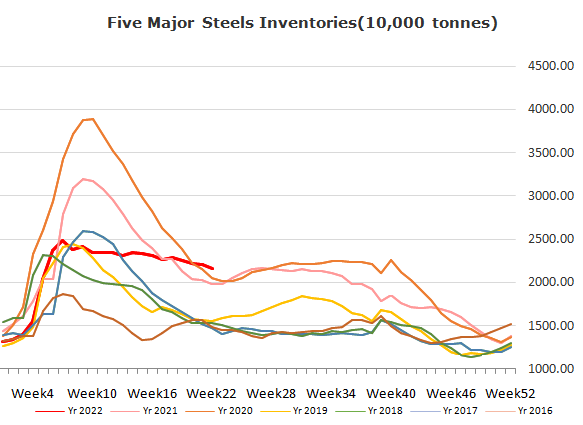

Steel Key Indicators

• Tier II and Tier III steel mills from Jiangsu, China received orders to restrict production in June, however not specifying the amount.

Coal Indicators

• The end-users were not confident on global coking coal price during the massive collapse on global steel prices. HCCA unbranded offered at $410, the offer was $420, last week at $430. Sellers apparently do not have enough confidence to firm the offer at solid level.