Market Verdict on Iron Ore:

• Bearish.

Macro

• U.S. S&P500 corrected by 4%, confirming an entrance into bear market analysed by Wallstreet analysts. However the Executive Director of Morgan Stanley James P Gorman believed that the probability of a recession in the US economy is 50%, but any downturn is unlikely to be serious.

Iron Ore Key Indicators:

• Platts62 $136.60, -4.95, MTD $142.97. Seaborne PBF gathered interests after import margin improved significantly. Iron ore seaborne trades significantly increased on previous two weeks. Rio Tinto sold quite a few laycans of Fe61% PBF on fixed price. BHP sold JMBF discount at $9-10. However steel mills margin was in 0 area, the marginal profit of some northern mills were even negative, which resist the big spike of current materials in mid-run level. Virtual steel margin was squeezed to extreme low area because iron ore increased faster than steel. As a result, buying interests from China end-users shift from mid-grade to low grade including Robe River Fines and Super Special Fines. There was higher offer on PBF at + $2.8 based on July Platts62 Index, however no bids showing on the market.

• MySteel iron ore 45 ports arrival 18.91 million tons, down 3.145 million tons w-o-w. Six northern ports arrivals 8.878 million tons, down 2.43 million tons w-o-w.

• Ukraine iron ore miner Ferrexpo said that it is curtailing production because of building up iron ore inventories and infrastructure damage.

SGX Iron Ore 62% Futures& Options Open Interest (Jun 10th)

• Futures 82,753,800 tons(Increase 1,979,400 tons)

• Options 78,485,000 tons(Increase 367,000 tons)

Steel Key Indicators

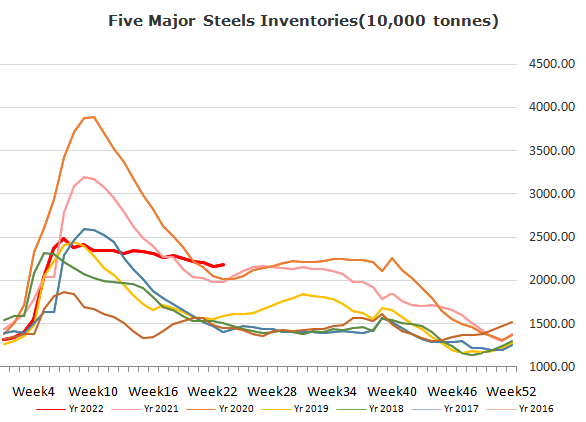

• Construction steel demand entered a lull as daily physical trading volume was 149,400 tons last week, lower than 180,000 in previous week. The average daily trading volume in June was 170,000 -180,000 tons.

Coal Indicators

• Australia FOB and CFR China PLV diverged further, CFR China current became $67.5 higher than Australia FOB, indicating a resilient Chinese demand came back to seaborne market after restricted for two months by the pandemic. The FOB used to be $80-90 higher than CFR in April.