Market Verdict on Iron Ore:

• Neutral.

Macro

• U.S. May PPI up 10.8% y-o-y, est. 10.9%, last 11%.

• ECB official indicated that July interest rate increase 25 basis points, and expect a 25 basis points increase in September.

• Gazprom announced that the gas supply through the Nord Stream about 100 million cubic meters per day, a decrease of nearly 40% compared with the original planned 167million cubic meters per day.

Iron Ore Key Indicators:

• Platts62 $134.20, -2.40, MTD $142.10. Seaborne PBF gathered interests after import margin improved significantly. Iron ore seaborne trades significantly increased on previous two weeks. Rio Tinto sold quite a few laycans of Fe61% PBF on fixed price. BHP sold JMBF discount at $9-10. However steel mills margin was in 0 area, the marginal profit of some northern mills were even negative, which resist the big spike of current materials in mid-run level. Virtual steel margin was squeezed to extreme low area because iron ore increased faster than steel. As a result, buying interests from China end-users shift from mid-grade to low grade including Robe River Fines and Super Special Fines. There was higher offer on PBF at + $2.8 based on July Platts62 Index, however no bids showing on the market.

SGX Iron Ore 62% Futures& Options Open Interest (Jun 14th)

• Futures 83,041,100 tons(Increase 287,300 tons)

• Options 79,010,700 tons(Increase 525,700 tons)

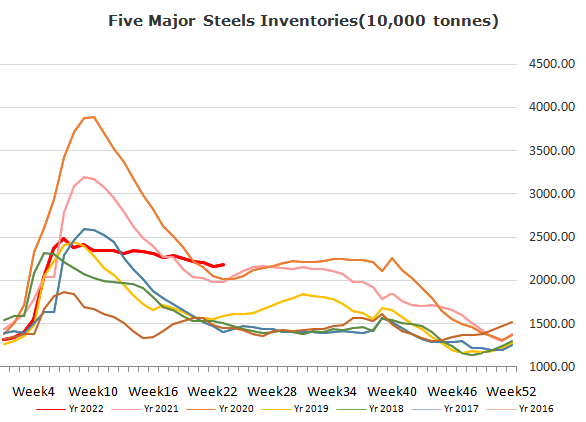

Steel Key Indicators

• Construction steel demand entered a lull as daily physical trading volume was 149,400 tons last week, lower than 180,000 in previous week. The average daily trading volume in June was 170,000 -180,000 tons.

Coal Indicators

• After Australia FOB market sharp falling over previous few weeks, buying interests emerged in the market. PLV was stable at $381/mt FOB Australia. China domestic coking coal market continued to strengthen as Shanxi Liulin high sulfur auctions saw 300 yuan/mt than starting price.