Market Verdict on Iron Ore:

• Neutral.

Macro

• U.S. Federal decided to increase interest rates by 75 basis points to 1.5- 1.75%, created the biggest single time rate hike since 1994.

• U.S. Financial Department statistic indicated that Chinese investors decrease U.S. bond holding to 1.003 trillion dollars. Japan decreased to the lowest since January 2020. Japan and China are the two biggest bond holder of U.S. T-bond.

Iron Ore Key Indicators:

• Platts62 $130.85, -3.35, MTD $141.07. Mainstream iron ores didn’t saw any active buyers during this week although improving import margins. The steel margin was suffering a loss. As expected, iron ore eroded steel mills margin and made an overdraft of growth in advance. Thus, mills are currently utilising premier coking coals to increase reducibility of low grade iron ore, which could reduce cost comprehensively. The 45% tax increase on Indian pellets and previous Ukraine supply disruption to Asian countries led to a global seaborne pellets shortage, which yet to see any alternative.

SGX Iron Ore 62% Futures& Options Open Interest (Jun 15th)

• Futures 84,192,000 tons(Increase 1,150,900 tons)

• Options 79,828,000 tons(Increase 817,300 tons)

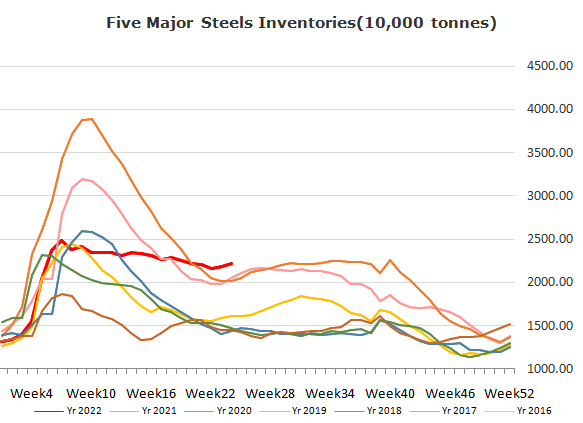

Steel Key Indicators

• Tangshan average billet cost 4508 yaun/ton, up 67 yuan/ton. Average profit – 128 yuan/ton.

Coal Indicators

• After Australia FOB market sharp falling over previous few weeks, buying interests emerged in the market. PLV was stable at $381/mt FOB Australia. China domestic coking coal market continued to strengthen as Shanxi Liulin high sulfur auctions saw 300 yuan/mt than starting price.