Market Verdict on Iron Ore:

• Neutral.

Macro

• During the first five months of 2022, Chinese industrial enterprises above designated scale reached 3.44 trillion yuan, up 1% on the year. Jan- Apr growth was 3.5%. The revenue growth reached 6.8% on the year.

Iron Ore Key Indicators:

• Platts62 $119.60, +4.60, MTD $131.14. PBF saw improving trade activities in seaborne market. Chinese steel mills expect margin could recover with initiative control on production in June and July. Thus, Chinese blast furnace utilisation rate expected to drop in the coming few weeks. BHP narrowed term contract discounts for July JMBF from 11% to 9.25%, widened discount for MACF from 2.75% to 4%.

• MySteel 47 Chinese ports iron ore arrivals at 23.38 million tons, down 1.22 million tons w-o-w.

• Rio Tinto announced that the Pilbara mining areas discovered a new project Gudai-Darri currently with expected service period over 40 years, annual capacity reached 43 million tons. The new project expected to achieve full capacity in 2023.

SGX Iron Ore 62% Futures& Options Open Interest (Jun 27th)

• Futures 96,385,300 tons(Decrease 593,000 tons)

• Options 89,022,500 tons(Unchanged)

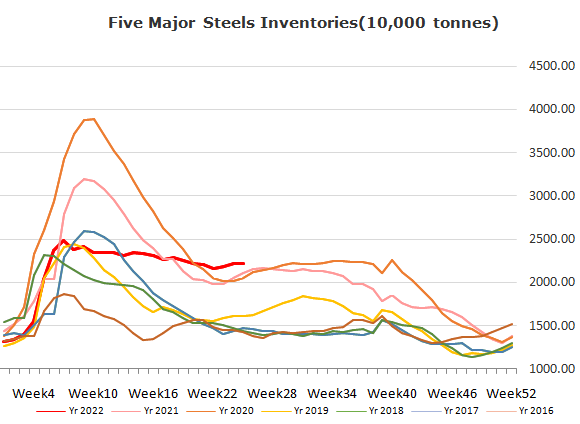

Steel Key Indicators

• 247 blast steel mills operation rate 81.92%, down 1.9% w-o-w, down 4.93% on the year.

• China 85 EAFs average operation rate 57.65%, down 3.11% w-o-w, down 25.36% on the year.

Coal Indicators

• Chinese coke market didn’t show continious bearish sentiment after coke price down 300 yuan/ton in June 20th. Traders were maintaining a watch and see mode.

• Chinese market regulation bureau decided to start a investigation window from June to September to crack down illegal actions on price gouging.