Market Verdict on Iron Ore:

• Neutral.

Macro

• China reduced Covid-19 related quantarine period, lifted sentiments on secondary market investments.

• ECB Finance Minister Lagarde reclaimed to hike 25 bp on interest rate in July, and inidcated that it is necessary to start more aggressive hike in this September.

Iron Ore Key Indicators:

• Platts 62%: $125.00 (+5.40) MTD $130.84. PBF saw improving trade activities in seaborne market. Chinese steel mills expect margin could recover with initiative control on production in June and July. Thus, Chinese blast furnace utilisation rate expected to drop in the coming few weeks. BHP narrowed term contract discounts for July JMBF from 11% to 9.25%, widened discount for MACF from 2.75% to 4%.

SGX Iron Ore 62% Futures& Options Open Interest (Jun 28th)

• Futures 98,058,800 tons(Increase 1,673,500 tons)

• Options 89,770,000 tons(Increase 747,500 tons)

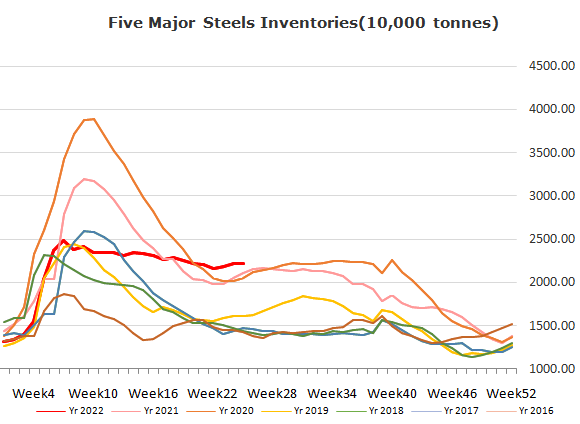

Steel Key Indicators

• 247 blast steel mills operation rate 81.92%, down 1.9% w-o-w, down 4.93% on the year.

• China 85 EAFs average operation rate 57.65%, down 3.11% w-o-w, down 25.36% on the year.

Coal Indicators

• Chinese market regulation bureau decided to start a investigation window from June to September to crack down illegal actions on price gouging.

• The second round of Chinese coke cut postponed, market sentiment warmed.