Market Verdict on Iron Ore:

• Neutral.

Macro

• China 100 cities new built houses traded 28.37 million square meters in June, up 37% from May, down 34% on the year. The year-on-year growth slowed down.

Iron Ore Key Indicators:

• Platts62 $116.45, -3.65, Jul Avg $116.45. The physical July and August iron ore structure become contango since market participants believed that the bottom of the market was approaching. Chinese steel mills expect margin could recover with initiative control on production in June and July. Thus, Chinese blast furnace utilisation rate expected to drop in the coming few weeks. Silicon penalties in 4.5-6% range dropped from $4 to $3, suggesting mills tolerance on variety of brands, to comprehensively decrease the cost of materials. Seaborne float premium on PBF used to narrow 80% in the first two weeks of June, however this number become less volatile from $0.55-0.85 in late half of June with no actual trade on float basis. JMBF cargoes saw more trades at July Index with a $8.9 discount because the improvement on quality. Previously BHP narrowed term contract discounts for July JMBF from 11% to 9.25%, widened discount for MACF from 2.75% to 4%.

• MySteel 45 ports iron ore inventories at 126.26 million tons, up 539,300 tons w-o-w. Daily evacuation 2.83 million tons, down 114,200 tons w-o-w. Australia iron ore 59.40 million tons, up 998,700 tons w-o-w. Brazil iron ore 41.53 million tons, down 901,700 tons w-o-w. 96 ships at ports, up 6.

SGX Iron Ore 62% Futures& Options Open Interest (Jul 1st)

• Futures 75,833,600 tons(Increase 1,045,600 tons)

• Options73,666,700 tons(Increase 876,500 tons)

Steel Key Indicators

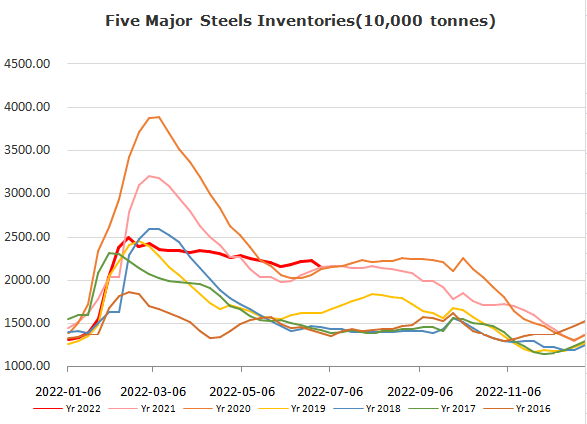

• Steelbank rebar inventory 7.26 million tons, down 3.62% w-o-w. HRC 3.21 million tons, up 1.08% w-o-w.

Coal Indicators

• The second round of Chinese coke cut postponed, market sentiment warmed.

• Few Shanxi steel mills started the second round of coke price cut by 200 yuan/ton, however there was some conflictions on the views regarding the cut.