Market Verdict on Iron Ore:

• Neutral.

Macro

• Chinese M2 supply up 11.4% in June, last 11.1%, est. 11.1%, beyond expectations.

• The Nord Stream I natural gas pipeline, Russia’s main gas pipeline to Europe, has begun annual maintenance and suspended gas transmission.

Iron Ore Key Indicators:

• Chinese steel mills expected that margin could recover with initiative control on production in June and July. Thus, Chinese blast furnace utilisation rate drop by more than 3% in June on the month. Seaborne float premium on PBF maintained around $0.55 to $0.65 on MOC platform over previous two weeks, however lack of buying interested on float basis cargoes. JMBF cargoes saw ample interests and trades with a $8.7-8.9 discount in current three weeks because the improvement on quality.

• Chinese 45 iron ore ports arrivals at 28.29 million tons, up 6.035 million tons w-o-w. Six Northern ports arrivals at 14.49 million tons, up 3.18 million tons w-o-w.

SGX Iron Ore 62% Futures& Options Open Interest (Jul 11th)

• Futures 85,417,300 tons(Increase 2,141,500 tons)

• Options 79,103,000 tons(Increase 675,000 tons)

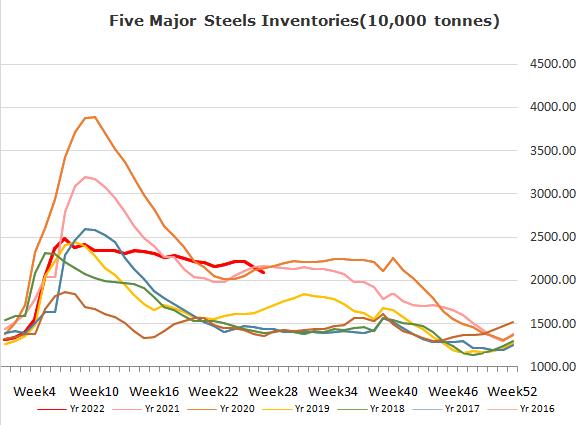

Steel Key Indicators

• China 2022 crude steel production target within 1 billion tons, a cut by 40 million tons on the year. MySteel expect the H2 2022 daily pig iron production at 2.1- 2.3 million tons.

Coal Indicators

• Australia PLV market saw huge correction during this week. FOB PLV corrected $42 for the last three days to $258. The significant drop was related to an Unbranded HCCA cargo offer down $37 at $253 while the most competitive bid currently stayed at $240.