Market Verdict on Iron Ore:

• Neutral.

Macro

• OPEC: Global oil supply tension yet to resolve. OPEC expected oil demand increase by 2.7 million barrels/day in 2023, with total demand at 30.10 million barrels, up 900,000 barrels/day from 2022.

• Goldman Sachs expected copper average price at $6700/mt, $7600/mt and $9000/mt in the coming three months, six months and twelve months respectively. Last estimation at $8650/mt, $10500/mt and $12000/mt

Iron Ore Key Indicators:

• Platts62 $105.80, -8.25, MTD $112.53. Chinese steel mills expected that margin could recover with initiative control on production in June and July. Thus, Chinese blast furnace utilisation rate drop by more than 3% in June on the month. Seaborne float premium on PBF maintained around $0.55 to $0.65 on MOC platform over the last two months, however lack of buying interested on float basis cargoes. Newman fines saw discount first time in the year. However seaborne trades through float basis were light in general. JMBF cargoes saw ample interests and trades, discount improved from $8.7-8.9 to $8.3.

SGX Iron Ore 62% Futures& Options Open Interest (Jul 12th)

• Futures 86,352,000 tons(Increase 3,076,200 tons)

• Options 80,470,500 tons(Increase 2,042,500 tons)

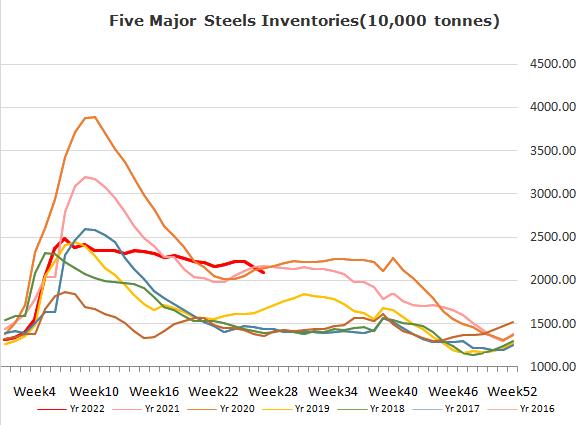

Steel Key Indicators

• China 2022 crude steel production target within 1 billion tons, a cut by 40 million tons on the year. MySteel expect the H2 2022 daily pig iron production at 2.1- 2.3 million tons.

Coal Indicators

• Australia PLV market saw an HCCA Unbranded PLV traded at $238. Market saw ample buyers to confirm this level as the periodic bottom.