Market Verdict on Iron Ore:

• Neutral.

Macro

• Reuters news indicated a letter from Gazprom had announced force majeure to at least one of its clients on the natural gas supply. U.S. white house predicted that OPEC + would increase oil supply after the talk between Joseph Biden and the middle-east countries.

Iron Ore Key Indicators:

• Platts62 $100.90, +4.30, MTD $108.62. Resurgence of Covid-19 spread in new areas of China, plus the unexpected high temperature hit China after an extreme rainy weather, and the steel mills joint production cut, cracked down the purchase on raw materials. Steel production is expected to go lower until the resolution of oversupply. Physical traders were trying to clear cargoes on hand.

• Chinese 45 ports iron ore arrivals at 21.87million tons, down 6.42 million tons w-o-w. Northern six ports arrivals at 12.095 million tons, down 2.39 million tons w-o-w.

SGX Iron Ore 62% Futures& Options Open Interest (Jul 18th)

• Futures 99,230,900 tons(Increase 1,428,200 tons)

• Options 85,253,000 tons(Increase 1,390,000 tons)

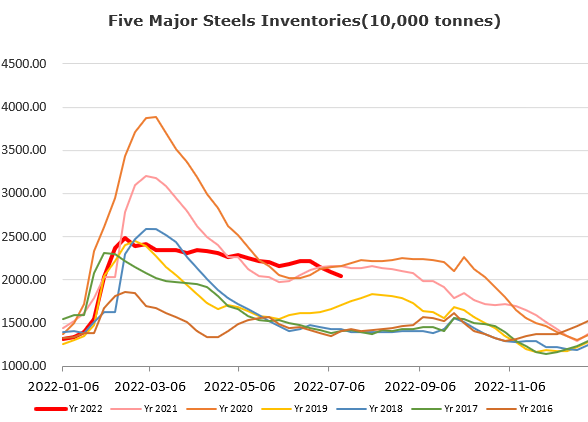

Steel Key Indicators

• China Shanxi province saw four new increased blast furnace maintenance. One of the mills cur utilisation by 25% because of the continuous marginal loss on production.

Coal Indicators

• Chinese top 10 coal makers total produced 1.13 billion tons of coals in H1 2022, up 90 million tons w-o-w. Top ten coal producers accounted for 51.6% of total coal capacity above designated scale.